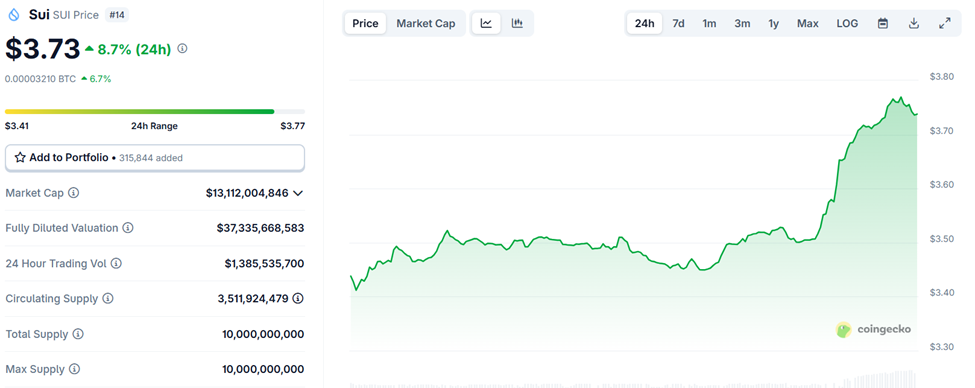

Sui ($SUI) rose 8.7% to $3.73 as institutional adoption and DeFi innovations continue to fuel its path toward $4. With a $13 billion market cap and growing developer activity, the Layer-1 blockchain is proving it’s more than just another altcoin pump.

Sui’s DeFi Growth, zkTunnels, and Real-World Integrations Boost Adoption

One of the standout innovations is Sui Network’s integration of zkTunnels, a new technology that supports real-time, fee-free operations in IoT robotics.

This upgrade could considerably improve how smart devices communicate and execute tasks, an important step for merging blockchain with real-world industries.

Institutional confidence in Sui is strong, exemplified by Mill City Ventures, a publicly traded company that invested $450 million in $SUI tokens. This substantial treasury adoption shows the trust large investors place in the network’s long-term potential.

Institutional adoption continues with AMINA Bank in Switzerland becoming the first globally regulated bank to offer custody and trading services for SUI tokens, demonstrating growing legitimacy and institutional integration. As we previously reported, AMINA had integrated Ripple’s RLUSD.

Sui is also disrupting the $600 billion digital advertising industry through its partnership with decentralized ad platform Alkimi. By bringing ad transactions on-chain, the collaboration between the firms ensures faster, more transparent, and fraud-resistant ad delivery, making a massive leap toward Web3-powered marketing.

To improve internal tech, Sui has joined hands with Google Cloud, integrating AI-powered APIs, advanced data analytics, and real-time chain indexing via BigQuery, positioning the blockchain as a next-gen network for enterprise adoption.

Sui continues its growth in DeFi, with its Total Value Locked (TVL) now standing at $2.093 billion, a strong indicator of its trajectory toward $4 and on the path to $10.

On the financial front, Bluefin, the leading decentralized exchange on Sui, launched Bluefin7K. This is a native aggregator that finds the best trading rates by routing trades across different DEXs on Sui, giving users deep liquidity and better prices.

Meanwhile, Volo, the largest liquid staking platform on Sui, has introduced the Volo wBTC Vault, a unique product that allows users to tap into Bitcoin liquidity within Sui’s ecosystem using a single command.

To ensure it can handle all this growth, Sui has also rolled out beta support for gRPC APIs, facilitating real-time data streaming for exchanges and developers.

SUI Market Breakdown—Rising Wedge Aftermath and Fresh Volume Momentum

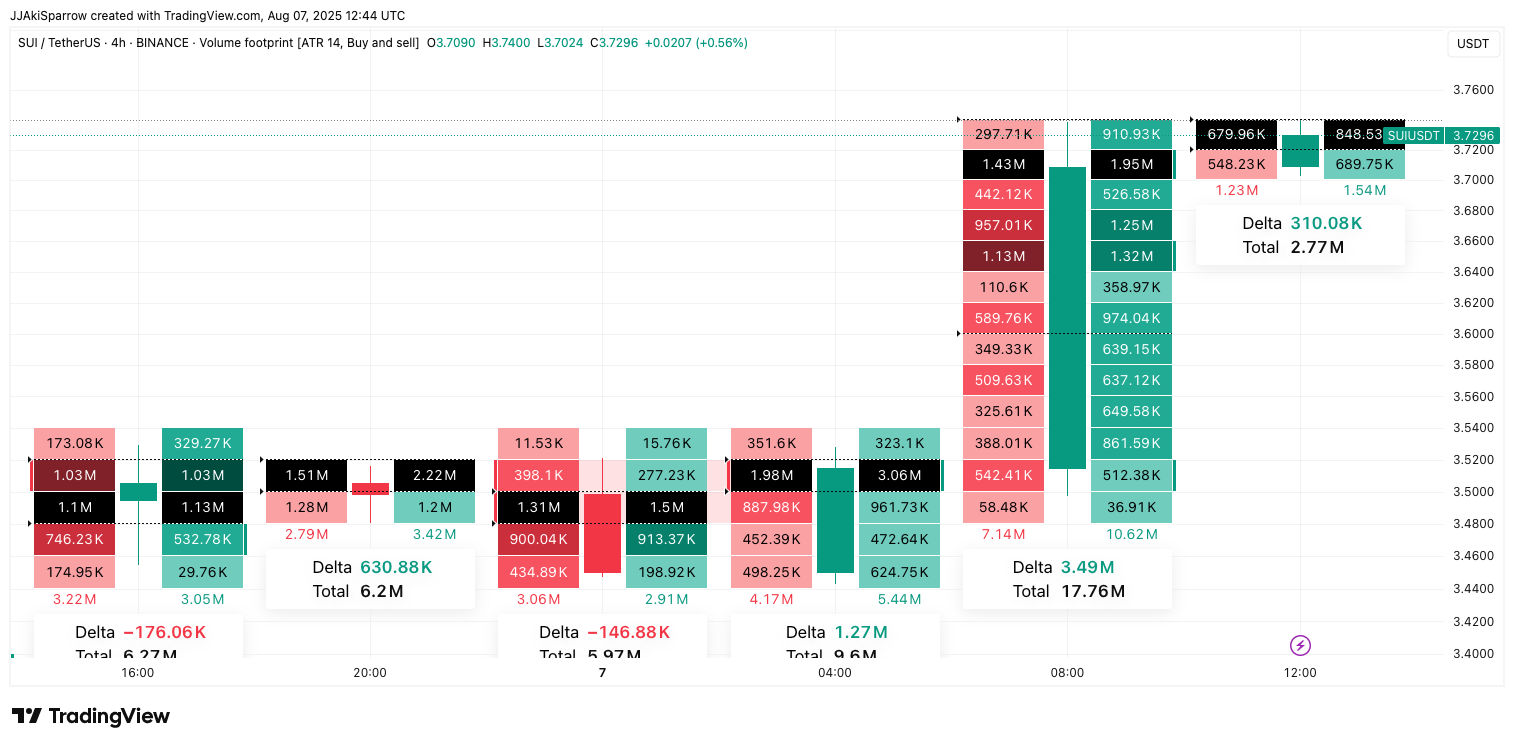

Sui’s recent price movement shows a clear breakdown of the rising wedge formation.

The 4-hour chart shows a broad wedge that took shape over several weeks in July, eventually breaking down with a steep drop from $3.7, slicing through support levels on high bearish momentum. That breakdown was brutal, pushing SUI below $3.20 before bulls started accumulating.

However, what’s interesting now is the attempt at recovery. The price has clawed back to the $3.73 level, pushing against resistance where the wedge first began to crack.

$SUI’s volume data isn’t spectacular, but it’s growing. There are visible but slightly healthier green bars that have emerged as buyers attempt to regain more ground. That’s where the volume footprint helps clarify the story.

On the 4-hour volume footprint, the shift in balance is clear.

Earlier in the journey, heavy sell imbalances (deltas like -176K and -146K) dominated, showing aggressive market selling. But recently, that’s changed rapidly.

The latest candle shows a total volume of 2.77M with a positive delta of 310K, suggesting that buyers are finally pushing back, slowly absorbing offers, and could possibly take control.

Despite these moves, the previous few candles show sellers were quite active, evident in those large red deltas and stacked sell blocks at key points of interest levels.

But with back-to-back green deltas of 1.27M and 3.49M before the most recent candle, it’s looking like the bulls are slowly grinding back in.

While the indicators and the volume are leaning bullish, the momentum must continue to build up to flip this breakdown into a full-blown bullish reversal.