Altcoin season is rewarding tokens with recent drivers and active market participation. The day’s rotation puts Synthetix in front, with Bittensor and Render following on strong category flows.

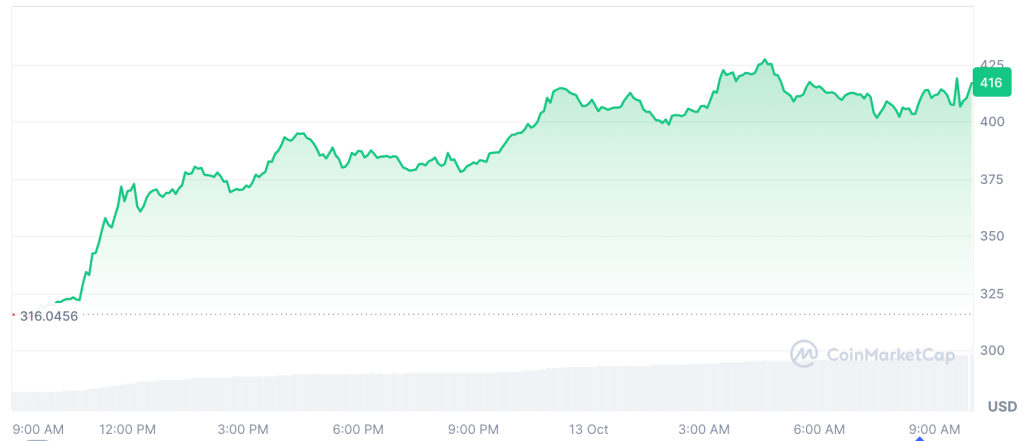

Price action sets the stage. Synthetix is currently trading near $2.26, up by over 130% in the past 24 hours. Bittensor is now valued at around $416, representing a 30% increase. Render changes hands near $2.87, up by 21%. Exchange data shows rising turnover across all three pairs, confirming participation rather than thin prints.

Synthetix (SNX): Perpetuals Launch Track And Crowded Short Covering

Synthetix is rallying on concrete steps toward a new perpetual exchange on the Ethereum mainnet. Team communications and product materials outline phased access, pre-deposits, and a dated trading competition with $1M in rewards.

The package includes gas-free execution mechanics, multi-collateral margin, and an off-chain matching layer that settles on the mainnet. Traders view this as a near-term utility boost that can convert attention into activity.

Order books show heavy bidding through prior resistance levels. Derivatives screens indicate a jump in open interest and a shift in funding after shorts crowded the range earlier this week. That shift aligns with the break of multi-month trend lines on spot charts. Put simply, a dated launch path, combined with a technical trigger, drew both systematic and discretionary buyers simultaneously.

Sustainability hinges on follow-through. Analysts are watching to see whether volumes remain high after the initial burst and whether enrollment in the competition tracks with the early sign-ups. Another marker is breadth across venues. If spreads stay tight and depth improves on secondary exchanges, the move can carry beyond a single session.

Bittensor (TAO): AI Basket Strength And Clean Levels

Bittensor’s advance arrives on a green day for AI-linked tokens. Category trackers show steady inflows into data and compute plays, and TAO often absorbs that flow due to its relative depth.

Bittensor Price (Source: CoinMarketCap)

Price reclaimed a key support area last week and pushed above a cluster around the low 300s, which opened up room toward the mid-400s on many technical maps.

Intraday readings show constructive funding and firm spot volumes. That mix suggests the move is not only leveraged in a directional sense but also cash buyers rebuilding their exposure to the AI theme. For confirmation, traders want to see TAO hold above reclaimed levels into the close and add to open interest without sharp funding spikes.

Render (RENDER): Compute Demand And Venue Breadth

Render is rising on renewed interest in GPU-backed compute and DePIN narratives. Activity screens show more consistent volumes across top pairs, while short-term charts indicate a reclaim of a resistance band that capped attempts earlier this month.

Options and perps positioning point to measured leverage rather than blowout risk, which often produces steadier climbs during altcoin season.

Desk chatter also notes improved market depth following recent venue enhancements. If spot volumes continue to expand and the token holds above today’s breakout zone, RNDR can keep pace with the broader compute basket.

Altcoin Season Read

Today’s rotation is anchored by clear trends. Synthetix has a dated mainnet rollout for perpetuals and an active competition that channels flows. Bittensor benefits from AI category strength and a clean chart reclaim. Render participates through improving venue breadth and persistent interest in computing.

The checklist from here is simple. Watch SNX volumes, competition enrollment, and delivery cadence on the launch path. Track TAO’s hold above reclaimed levels while AI screens stay green. Monitor RNDR’s spot depth and whether the breakout band turns into support. If these markers persist, this pocket of altcoin season can extend into the following sessions.