On September 2, 2025, ETHZilla Corporation, a Nasdaq-listed company backed by prominent investors including Peter Thiel, announced a $100 million deployment of its Ethereum reserves into EtherFi, a liquid restaking protocol.

The decision marks ETHZilla’s first direct integration with DeFi infrastructure. The firm seeks to generate higher yields on its holdings while strengthening Ethereum’s network security.

ETHZilla Leverages EtherFi to Unlock Yield on ETH Holdings

Executive Chairman McAndrew Rudisill described the shift as a “strategic evolution” in treasury management. “By deploying $100 million into liquid restaking, we’re reinforcing Ethereum’s security while unlocking incremental yield opportunities to enhance returns on our treasury holdings.

Partnering with EtherFi marks a pivotal step in our engagement with DeFi,” Rudisill said in the release.

The allocation represents a portion of ETHZilla’s 102,246 ETH reserves, valued at approximately $456 million as of August 31. In addition to its crypto holdings, the company maintains $221 million in cash equivalents and has more than 166 million shares outstanding.

According to data from the company’s capital summaries, ETHZilla aggressively expanded its Ethereum position through August, acquiring over 20,000 ETH at an average purchase price of $3,949.

EtherFi, the protocol selected for the investment, offers enhanced yield through restaking, a process that allows staked ETH to be rehypothecated into additional security layers and services beyond Ethereum’s core validation.

Mike Silagadze, founder and CEO of EtherFi, called ETHZilla’s entry a watershed moment.

“Their commitment highlights the growing institutional confidence in decentralized protocols and showcases a unique method of bridging traditional finance with the Ethereum ecosystem,” Silagadze said.

The move follows ETHZilla’s rebranding from 180 Life Sciences Corp. in late July, when the company pivoted to digital assets and adopted Ethereum as its central treasury reserve.

Backed by more than 60 institutional and crypto-native investors, the firm announced plans to raise $425 million through a private investment in public equity (PIPE) deal, supplemented by $150 million in potential debt securities.

Proceeds from the financing have been earmarked for ETH acquisitions, treasury operations, and transaction costs. ETHZilla’s treasury strategy is managed in partnership with Electric Capital, which is overseeing an on-chain yield program intended to outperform standard ETH staking.

The company has stated that its broader plan involves a mix of lending, liquidity provisioning, and structured agreements, designed to balance yield optimization with risk controls.

ETHZilla Evolves Into Educator and Investor as Ethereum Restaking Gains Traction

ETHZilla recently canceled 1.3 million outstanding shares held by Elray Resources in a $1 million settlement, streamlining its capital structure as it deepens its focus on crypto. The move follows its broader push to position itself not only as an investor but also as an educator.

Its “Ethereum School” publishes weekly lessons on monetary policy and staking economics, with recent material emphasizing how Ethereum’s fee burn and issuance model have reduced net annual issuance since the 2022 Merge to just 0.139%, showing its deflationary potential.

Meanwhile, liquid restaking continues to grow across the ecosystem. Total value locked in Ethereum protocols has climbed to $30 billion, driven by validators shifting away from native staking. EtherFi leads the sector in TVL, ahead of Eigenpie by offering users restaking yields via EigenLayer.

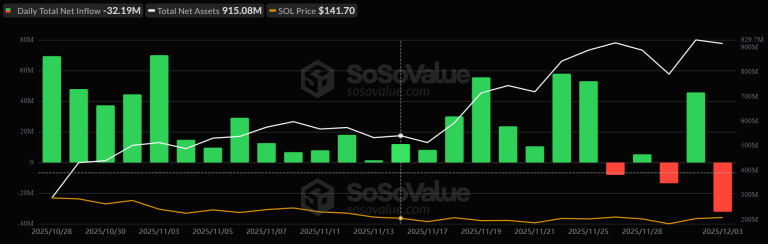

Corporate demand for Ether remains strong. According to SER data, Tom Lee’s BitMine holds about 1.8 million ETH, while Joe Lubin’s SharpLink ranks second with 837,000 ETH. SharpLink added 39,008 ETH between August 25 and 31 at an average price of $4,531, raising its treasury value to $3.6 billion.