The Trump administration has renewed its commitment to building a Strategic Bitcoin Reserve despite scant mention in its latest official digital asset report. Bo Hines, head of digital assets at the White House, confirmed the plan is operational: “We have it, it’s been established.”

Though exact holdings remain undisclosed, the U.S. government currently controls an estimated 198,000 BTC, worth over $23 billion, mostly from law enforcement seizures.

Hines emphasized that Bitcoin holds “a class of its own,” noting that the infrastructure to manage these reserves will roll out “in short order.”

This marks a major shift in U.S. digital asset policy—one that signals institutional confidence in Bitcoin’s long-term value as a sovereign asset. Alongside this, the White House urged regulatory collaboration between the SEC and CFTC to accelerate crypto adoption.

SEC Launches Landmark Crypto Reforms

More good news for the bulls, SEC Chairman Paul Atkins announced sweeping reforms to define and disclose cryptocurrencies. At the America First Policy Institute, Atkins called this a “once in a generation” opportunity to simplify token classification and make tokenized securities more accessible.

This comes on the heels of the Trump crypto working group’s proposal for federal digital asset trading. With both political and regulatory backing, Bitcoin’s path to mainstream is getting clearer. Clarity will reduce institutional fear and increase adoption.

Whale Accumulation vs. $9B BTC Sell-Off

On-chain data reveals a tug-of-war between long-term holders and sudden large-scale sellers. According to Santiment, whales have acquired nearly 1% of the total BTC supply in just four months, including 30,000 BTC in the last 48 hours.

Meanwhile, a Satoshi-era whale offloaded 80,000 BTC (worth $9B) via Galaxy Digital, triggering short-term volatility.

Still, most BTC holders remain profitable—glassnode estimates that 97% of Bitcoin supply sits above cost basis, a bullish metric. Whale activity has also spilled into other assets like Ethereum, Solana, PEPE, and WIF. In July, SharpLink Gaming invested $780M in ETH, doubling down on crypto diversification.

This combination of accumulation and profit-taking suggests a volatile but upward-biased Q3, with long-term conviction intact.

Bitcoin Breaks Support – Is $110K Next?

Bitcoin price action reflects the uncertainty. BTC/USD is at $115,775, below $116,872 horizontal support and the 50-SMA at $117,919. The triangle breakdown is confirmed by RSI at 33, and bearish momentum is in full swing.

- Recent candles are a spinning top followed by a big bearish engulfing candle.

- RSI divergence from price shows weakening bullishness

- Key support zones: $114,532, $112,726, $110,587

Technically, the failed triangle projects to $110,000 unless we see a quick bounce.

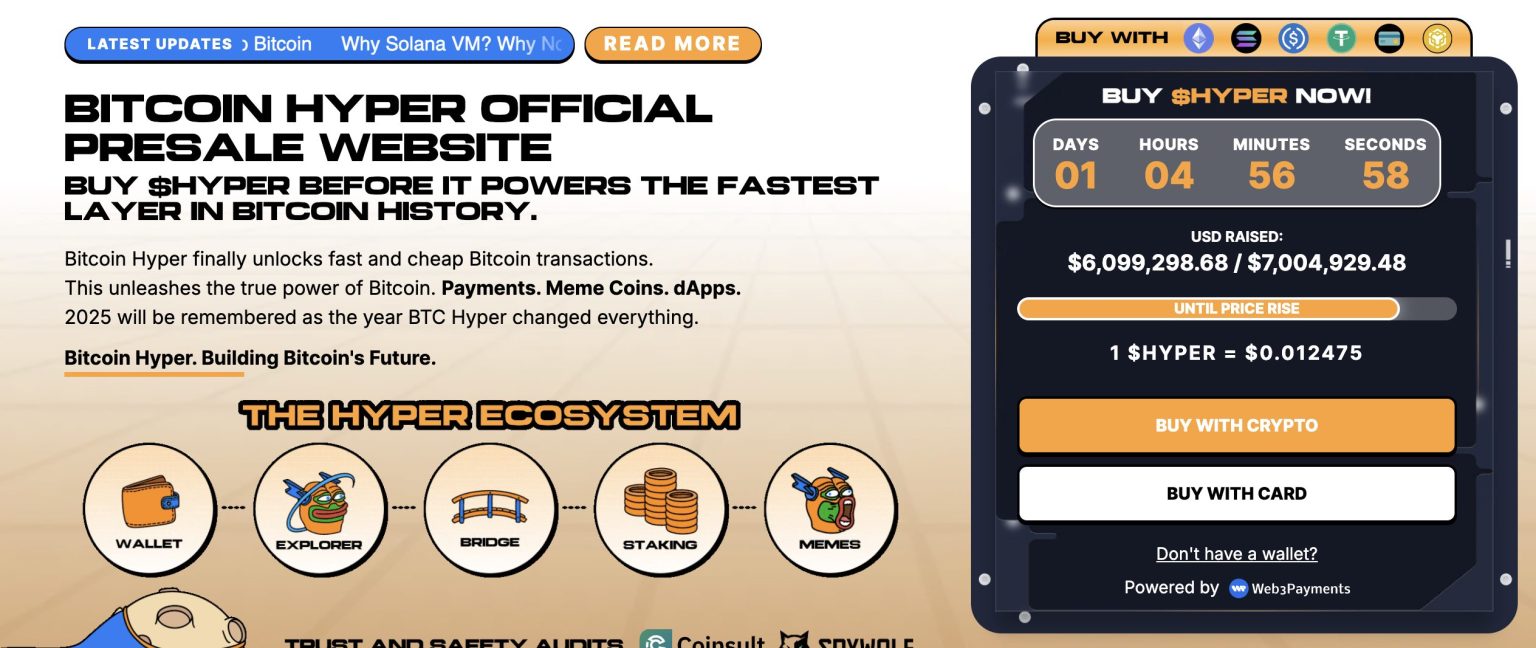

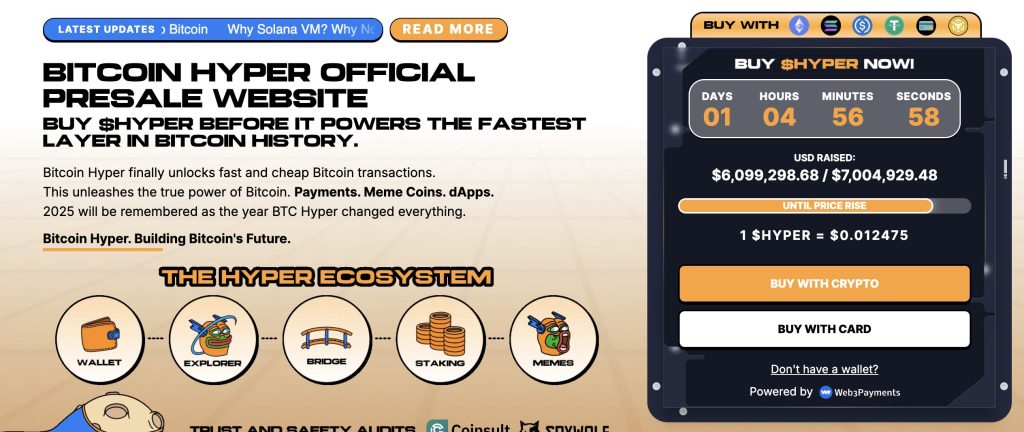

Bitcoin Hyper Presale Over $6M as Price Rise Nears

Bitcoin Hyper ($HYPER), the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM), has raised over $6 million in its public presale, with $6,098,717 out of a $7,004,929 target. The token is priced at $0.012475, with the next price tier expected to be announced soon.

Designed to merge Bitcoin’s security with Solana’s speed, Bitcoin Hyper enables fast, low-cost smart contracts, dApps, and meme coin creation, all with seamless BTC bridging. The project is audited by Consult and engineered for scalability, trust, and simplicity.

The golden cross of meme appeal and real utility has made Bitcoin Hyper a Layer 2 contender to watch in 2025. With staking, a streamlined presale, and a full rollout expected by Q1, $HYPER is gaining serious traction.