Crypto prediction platforms have become an unexpected scoreboard for the Trump-Musk feud that escalated last week. On Polymarket alone, bettors have staked more than half a million dollars on whether Donald Trump will face impeachment in 2025, while smaller markets are tracking odds on everything from Elon Musk unfollowing the President on X to the pair patching things up before July.

The scale and granularity of these wagers reveal how closely crypto natives are treating the feud as both entertainment and a proxy for political risk.

Musk’s musings about launching a centrist party nudged odds of him actually doing so to roughly one in five, for example, while a fleeting rumor of a Trump-Musk phone call sent reconciliation contracts surging before plummeting when Trump publicly dismissed the idea.

Even the more outlandish contracts—such as a 4% chance that Trump could somehow land Musk behind bars—show traders’ appetite for turning every twist into a tradable event.

Polymarket Bets on Musk’s Next Click

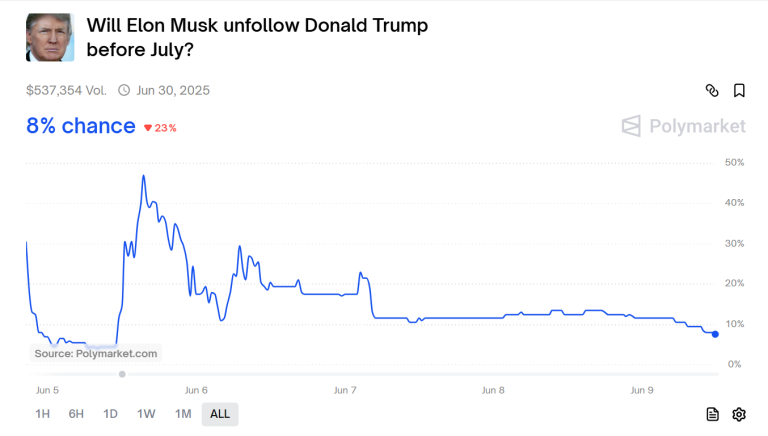

Traders tracking the Trump-Musk feud have zeroed in on one symbolic act: whether Elon Musk will remove Donald Trump from his X-following list.

The contract asking if Musk will unfollow the President before July 2025 hovered between 8% and 12% implied probability in recent sessions, reflecting guarded skepticism rather than outright dismissal of the move.

Source: Polymarket / Will Elon Musk unfollow Donald Trump before July

A short-term variant tied to an early June deadline drew about US$57,000 in volume—modest by Polymarket standards yet brisk for a pure etiquette play.

Order-book data shows bursts of activity after each public jab: when Trump labeled Musk “the man who has lost his mind,” “Yes” shares briefly ticked up before sellers moved in, restoring the status quo. The market’s seesaw illustrates how quickly headlines translate into price swings on decentralized exchanges.

Key takeaways at a glance:

- Implied odds: 8%–12% in recent sessions.

- Liquidity spikes: Align with new insults or supportive reposts on X.

- Average trade size: Under US$100, pointing to heavy retail participation.

- Sentiment split: Bulls frame an unfollow as a likely next-step escalation; bears note Musk’s penchant for monitoring rivals rather than muting them.

Account Suspension Odds Plummet on X

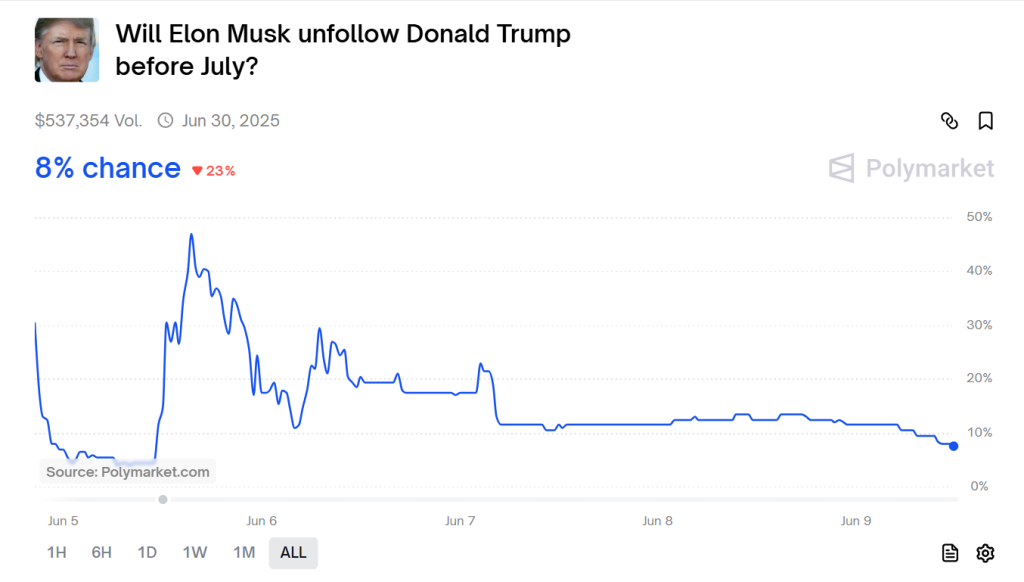

If an unfollow seems plausible, outright de-platforming does not. A separate contract asking whether Trump’s X account will be suspended by next Friday opened at a high of 3.9% but collapsed to ~1% within two trading days.

Source: Polymarket / Will @realDonaldTrump be suspended by Friday?

The sharp decline followed commentary from Musk reaffirming his free-speech stance and analysts pointing out the immense political cost of banning a sitting president.

Liquidity on this market has thinned as the price approached its floor, indicating consensus that a suspension is near-impossible under current circumstances.

Key points:

- Probability crash: 3.9% → ~1% in 48 hours.

- Low ongoing volume: The contract is now largely dormant.

- Driving factor: Musk’s public commitment to minimal content policing.

- Market interpretation: Bettors view a ban as “nuclear,” thus relegating it to tail-risk status.

Together, these social-media flashpoints underline how the feud’s smallest gestures—an unfollow, a ban button left untouched—become tradable indicators, shaping real-time odds in the wider crypto prediction ecosystem.

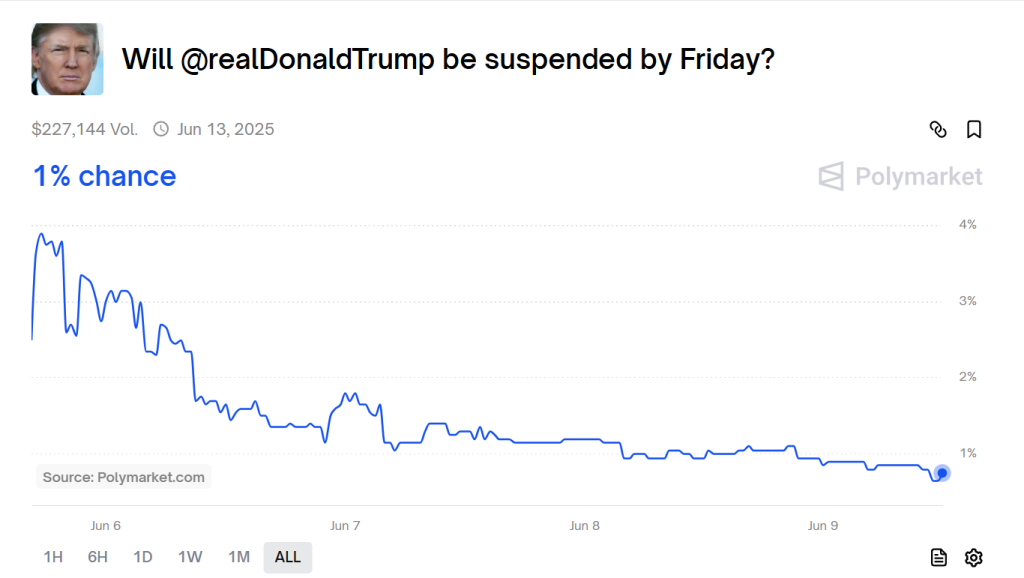

Reconciliation Odds Sway With Every Rumor

The prospect of Donald Trump and Elon Musk burying the hatchet remains one of the most closely watched subplots of the Trump-Musk feud. On Polymarket, the “public reconciliation before July” contract has settled into a 24% range, but that figure has whipsawed with each new headline.

When Politico floated the possibility of a private call between the two, “Yes” bids spiked; mere hours later, Trump’s televised remark that Musk had “lost his mind” sent the contract tumbling on a rush of “No” orders.

A parallel, shorter-tenor wager on Kalshi mirrored the drama, diving from 36% to 14% on Friday..

Key momentum shifts:

- Event catalyst: Rumored phone call → brief rush of “Yes” buying.

- Trump rebuttal: Sharp verbal jab → immediate sell-off in reconciliation odds.

- Liquidity pattern: Trade volume peaks within 30 minutes of each news break.

- Current sentiment: Roughly two-thirds of traders expect continued acrimony through June.

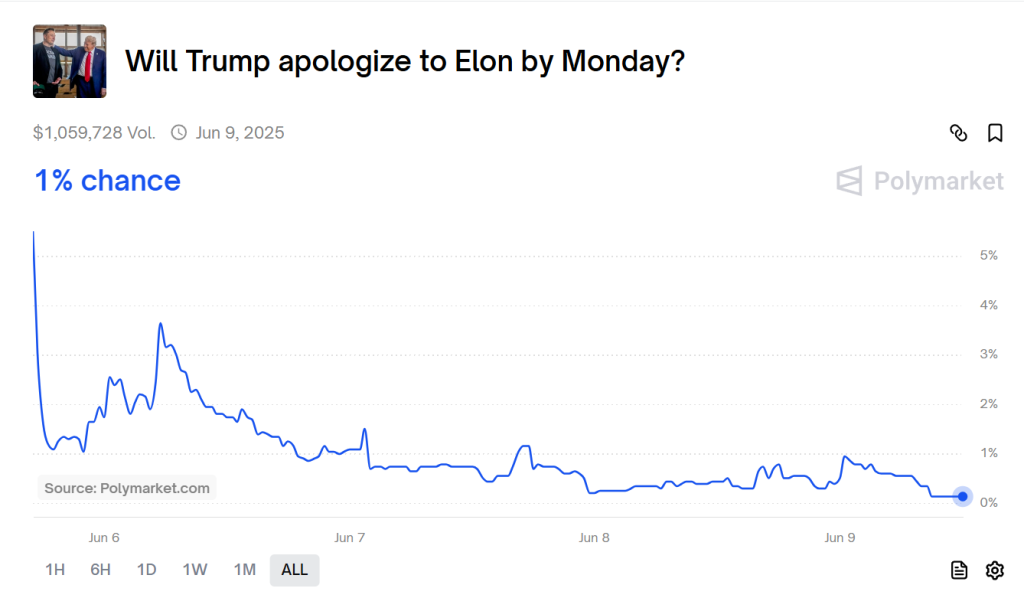

Apology and Insult Markets Paint a Bleak Picture

If reconciliation seems uncertain, outright contrition appears fantastical. The Polymarket line on Trump apologizing to Musk by June 9 is pinned near 1%, a level that traders treat as functionally impossible.

Source: Polymarket / Will Trump apologize to Elon by Monday?

Conversely, the market questioning whether Trump would publicly insult Musk (a contract opened at 12%) rocketed to the maximum price once the “lost his mind” quote hit cable news, locking in a market-implied near-certainty of insult.

Additional indicators from feud-focused contracts:

- Phone-call likelihood: 57% by year-end, only 14% this month.

- Meeting odds: Similar curve—low near-term, majority chance by December.

- Average ticket size: Under US$150, suggesting broad retail dabbling rather than whale dominance.

- Trader narrative: Ego clashes dominate discussion boards, with users betting that “spectacle sells better than a handshake.”

Taken together, apology and insult pricing confirm that bettors view cordiality as a long shot while expecting more rhetorical fireworks before any détente takes shape.

Musk’s Third-Party Gambit Gains Speculative Traction

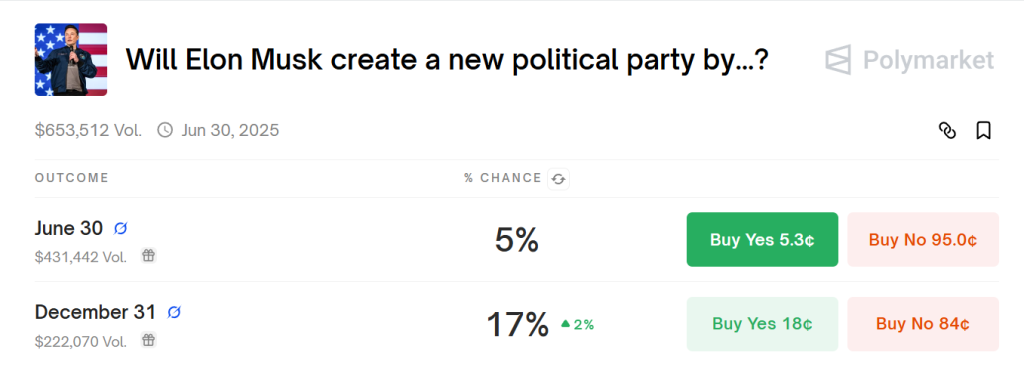

Barely a day after Elon Musk floated the idea of a centrist political party, posting an X poll that drew more than five million votes with roughly 80% in favor, prediction markets repriced the possibility.

On Polymarket, the contract asking whether Musk will form a new U.S. party by December 2025 now implies a 17% chance. A shorter window ending in June 2025 carries just 5% odds, showing skepticism that such a complex undertaking will materialize quickly.

Source: Polymarket / Will Elon Musk create a new political party by…?

The very existence of a tradable line illustrates how the Trump-Musk feud has warped traditional political timelines; traders are willing to wager real money on a scenario that six months ago sounded like science fiction.

Key data points shaping the market:

- Volume trend: Tens of thousands of dollars traded since the poll, with liquidity climbing whenever Musk revisits the subject on X.

- Investor split: Short-term bears cite logistical hurdles—ballot access, funding, and legal structures—while long-term bulls believe Musk’s brand and capital could upend the two-party status quo.

- Sentiment driver: Each favorable poll or supportive repost nudges “Yes” bids higher, but odds pull back whenever Musk shifts focus to SpaceX or Tesla updates.

- Historical context: No modern presidential contender has successfully launched a viable third party within two years, a fact repeatedly cited in trader chat rooms to cap enthusiasm.

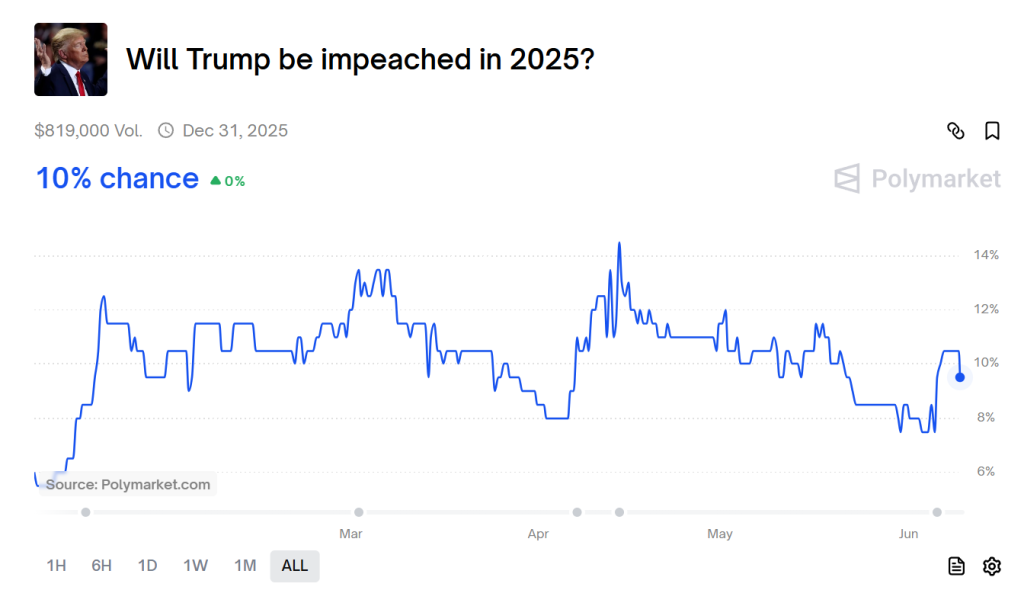

Impeachment Odds Show Real Political Risk

While a Musk-led party remains speculative, the market for a 2025 impeachment of Donald Trump has become one of Polymarket’s largest cash magnets.

Source: Polymarket / Will Trump be impeached in 2025?

Open interest now exceeds US$800,000, and implied probability has crept up to 11%—a modest but measurable rise after Musk amplified calls for Trump’s removal over a GOP spending bill. For comparison, impeachment contracts for sitting presidents rarely breach the mid-teens without an active scandal, making a double-digit line this early in the term unusual.

What traders are watching:

- Catalyst effect: Every sharp Musk criticism (especially tweets invoking impeachment) adds a percentage point or two to “Yes” pricing.

- Party control calculus: Skeptics emphasize Republican dominance in the House, keeping odds below 15%.

- Liquidity concentration: Large single-ticket wagers (US$10k+ blocks) suggest institutional or whale participation, a rarity in feud-specific markets.

- Risk hedging: Political consultants reportedly use the contract to hedge against legislative paralysis that could affect policy-sensitive sectors such as defense and energy.

Together, the party-creation and impeachment markets show how the Trump-Musk feud is feeding long-horizon bets with genuine policy implications.

As of 12:45 p.m. ET on June 9, 2025, the Solana-based Official Trump (TRUMP) token changes hands at $10.62, up 1.7% in the past 24 hours and roughly 4.8% on the week. Meanwhile, Dogecoin (DOGE)—still Elon Musk’s tongue-in-cheek favourite—trades at $0.1868, a slim 0.8% daily gain and about 2% higher than last Monday.

Lawsuit Talk: Could the Courtroom Host the Next Round?

While the Trump-Musk feud has largely played out on television screens and social feeds, a Kalshi contract now pegs the chance of Trump filing a lawsuit against Elon Musk in 2025 at roughly 18%.

That probability may look small, yet it is high enough to attract steady inflows whenever the President hints at legal retaliation. Traders cite several theoretical flashpoints—from defamation claims to alleged business interference—as pathways to litigation, though none have been formally pursued.

Key indicators:

- Liquidity pattern: Modest but growing; new money enters whenever Trump’s advisors reference “legal options.”

- Price sensitivity: A single Trump statement can move the line by 2–3 percentage points.

- Participant base: A mix of retail punters and a handful of larger accounts hedging reputational risk for companies exposed to the feud.

- Context check: Despite recurring threats, Trump has historically favored public sparring over protracted courtroom battles with high-profile entrepreneurs.

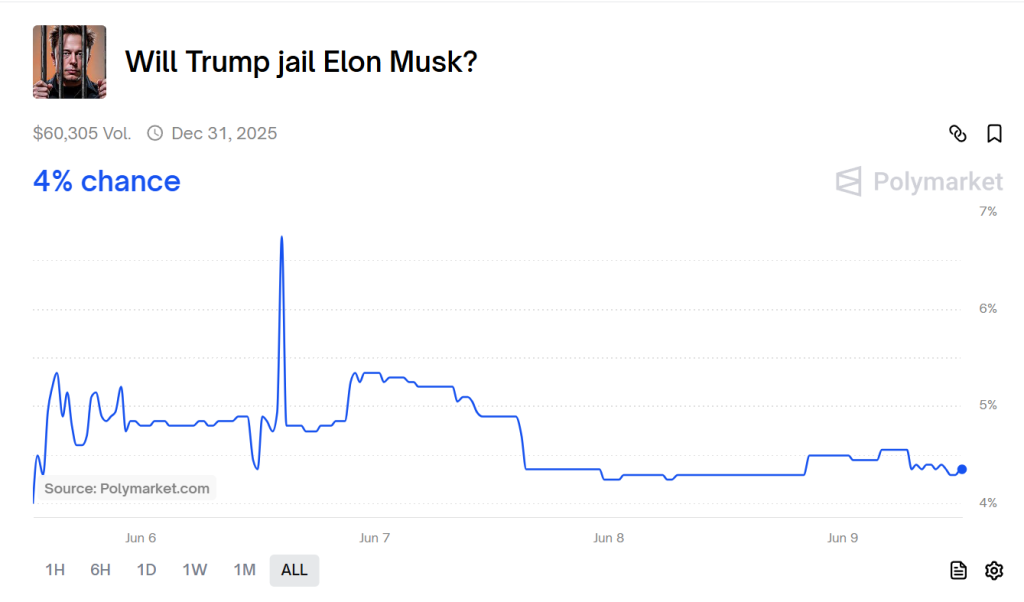

Jail-Time Contract Shows Appetite for Extreme Outcomes

The wildest of the crypto prediction market lines asks whether Trump will succeed in putting Musk behind bars during his term. On Polymarket, “Yes” shares briefly rallied to 6.8% before sanity reasserted itself, pushing the figure down to about 4%.

Source: Polymarket / Will Trump jail Elon Musk?

Though traders now see imprisonment as a remote possibility, the contract still commands attention, and roughly US$60,000 in combined open interest across Polymarket’s black-swan cluster.

Key takeaways:

- Early spike catalyst: Trump’s off-the-cuff threats against Musk-linked businesses fanned speculative buying.

- Rapid correction: Legal experts on X argued the scenario had no practical basis, prompting a cascade of “No” sells.

- Current spread: The bid-ask gap has widened as volatility drops, showing consensus around a low-probability tail risk.

- Psychology angle: Bettors treat the line as both an insurance hedge and a tongue-in-cheek barometer of political animosity.

Together, the lawsuit and jail-time contracts reveal a core dynamic of the feud’s more sensational wagers: even outcomes deemed highly unlikely still attract real dollars, illustrating how prediction markets convert headline hyperbole into quantifiable market sentiment.

Why the Trump-Musk Feud Bets Matter

Each price move in the Musk-Trump feud markets captures real money weighing reputational jolts, legislative risk, and even the remote chance of courtroom drama, giving outsiders a live barometer of public sentiment that traditional polling can’t match.

The data show bettors doubt dramatic flashpoints such as an X suspension or a presidential apology, yet they assign meaningful probabilities to longer-horizon pivots: a Musk-branded third party, an impeachment push energized by the feud, or a strategic lawsuit. In other words, traders are discounting the theatrics while hedging against structural shocks.

For readers, the takeaway is less about cheering for either protagonist and more about recognizing that decentralized markets now sit at the intersection of politics, celebrity, and finance, translating every tweet, press-conference jab, or viral poll into immediate, quantifiable fallout.

Against the backdrop of soaring volumes, the markets offer a real-time snapshot of public sentiment toward two of the most polarizing figures in politics and tech, and they are rewriting how quickly narrative drama can be monetized.