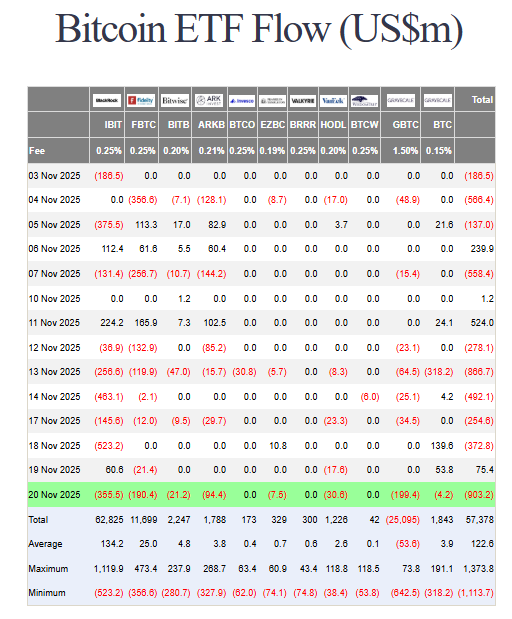

US Bitcoin spot exchange-traded funds (ETFs) witnessed a total net outflow of $903 million on November 20, marking the second-largest outflows since the fund’s inception in January 2024.

Meanwhile, per SoSoValue data, Ethereum spot ETFs recorded another $262 million in outflows, logging eight consecutive days of net outflows.

BlackRock’s iShares Bitcoin Trust (IBIT) bled $355.50 million as of 20 November, still leading the exodus. It was followed by Grayscale’s GBTC fund, marking a net outflow of $199.35 million on Thursday alone.

Data show that U.S. spot bitcoin ETFs bled nearly $3 billion in net outflows in November as the market faces a fresh technical breakdown.

Alternatively, Solana ETFs and XRP ETFs saw $23,66 million and $118,15 million in net inflows, respectively, on Thursday.

Massive ETF Outflows Signal Profit-Taking?

According to crypto exchange Luno’s insights, ETF outflows point to “risk-off positioning”, with large investors locking in profits ahead of year-end.

“Institutional investors are leading the charge, with ETF outflows signalling profit-taking and risk-off positioning,” Rachael Lucas, crypto analyst at BTC Markets, told The Block.

Przemysław Kral, CEO of European crypto exchange zondacrypto, told Cryptonews that long-term investors now have a chance to accumulate tokens at lower rates, while short-term traders might face challenges in timing a recovery.

“Significant outflows from Bitcoin ETFs indicate that institutional players are taking profits off the table.”

Bitcoin Plunges Over 9% – Further Decline Imminent?

Bitcoin fell more than 9% in 24 hours, stemming from a trifecta of institutional exits, miner economics, and technical triggers. The largest crypto is currently trading at $83,884 at the time of writing.

Przemysław Kral told Cryptonews that there is potential for BTC to decrease further.

“But it is important to note that large Bitcoin holders are still buying. This is a sign of underlying strength and confidence in the project, even though the price is falling,” Kral added. “For some, this could be a chance to enter the market at a lower price than we’ve seen recently. Therefore, it is important to recognise the risks. Volatility is high, and the macro environment can change quickly.”