Recent Bitcoin (BTC) price swings have been unsettling for short-term traders, prompting some to question whether the market is undergoing a temporary correction or entering a prolonged downturn.

However, for long-term retirement investors—particularly those using Bitcoin IRAs—price dips can offer strategic entry points rather than reasons for concern.

Jonathan Rose, CEO of BlockTrust IRA, told Cryptonews that downturns often create the most compelling opportunities. He noted that the recent crypto pullback resulted in one of the busiest weeks ever for BlockTrust IRA, a U.S.-based platform that allows retail investors to hold crypto in tax-advantaged retirement accounts.

“We are seeing a huge shift of investors putting crypto in BlockTrust IRAs, which indicates that Bitcoin is here to stay and that this is a great price entry opportunity,” he said.

Data from Alto, a platform that allows users to add alternative assets to self-directed retirement accounts, echoes this trend. The company reported that its 29,000 self-directed IRA users executed over 240,000 crypto trades last year.

Alto also stated that proprietary data from its platform reflects the growing confidence in crypto investments as part of a self-directed IRA.

A Long-Awaited Entry Point for Retirement Investors

Rose added that Bitcoin’s recent dip has opened the door for investors who previously felt like they had “missed the boat.”

“For retirement investors who plan to hold Bitcoin for 10, 20, or even 30 years, dips simply represent lower entry points,” he said.

This sentiment is shared across the industry. Ryan Flynn, head of Swan Advisor at Swan Bitcoin—a Bitcoin-only wealth management firm—told Cryptonews that Swan sees increased buying activity across all account types during drawdowns, including IRAs.

“Drawdowns in Bitcoin’s price are normal as Bitcoin continues its path of monetization and represents a buying opportunity for those who understand its fundamentals,” Flynn said.

Jad Comair, CEO of Melanion Capital, added that Bitcoin’s pullbacks differ from traditional assets. He explained that traditional stock investments typically drop when fundamentals are deteriorating. However, Comair pointed out that Bitcoin investments work differently.

“Bitcoin’s fundamentals don’t change when the price pulls back. The supply schedule remains fixed, the halving cadence continues, and global adoption keeps expanding,” he stated.

Tax Benefits Strengthen the Case for Buying the Dip

While lower prices alone create attractive buying conditions, Bitcoin IRAs offer additional advantages.

The most obvious advantage of a Bitcoin dip is the chance to acquire more BTC for the same dollar amount. In a tax-advantaged retirement account, this effect compounds over decades.

With a Traditional Bitcoin IRA, gains are tax-deferred; in a Roth Bitcoin IRA, gains can grow tax-free. Accumulating BTC at discounted prices inside these structures maximizes long-term appreciation without triggering taxable events along the way.

“In Roth IRAs specifically, this allows for more of Bitcoin’s future price action to be captured as tax-free appreciation. Drawdowns allow retirement investors to max out capped annual contributions, increasing the account’s Bitcoin exposure,” Flynn explained.

He added that when Bitcoin pulls back from $125k to $90k, the same $7k annual contribution purchases nearly 40% more Bitcoin.

“These advantages accrue mostly to the investor who is preparing for retirement in the next 5-10 or more years,” Flynn stated.

Yet, Flynn pointed out that disadvantages can particularly impact those investors who are already in retirement or are nearing that period. This is because these individuals have less time to recover to previous highs before distributions begin.

“There is a behavioral risk that puts those investors who don’t understand what Bitcoin represents at a disadvantage where they may be more likely to panic sell near local bottoms,” Flynn said.

Jonathan Bander, CPA at a New York-based public accounting firm ExperityCPA, further told Cryptonews that while a drop in BTC enables tax-loss harvesting to offset gains, disadvantages include no offset for personal income inside IRAs and ongoing volatility risk.

Who Should Consider a Bitcoin IRA?

While industry experts generally agree that Bitcoin dips can favor long-term retirement investors, suitability varies by investor.

Crypto is highly volatile and may be more susceptible to manipulation than registered securities. Because of this, Comair believes younger investors may be best positioned to benefit.

“They have the longest runway to let Bitcoin’s structural appreciation compound and can treat volatility the same way they would treat another major company’s historic drawdowns,” he said.

Comair added that investors with stable cash flow and low liquidity pressure may also find a Bitcoin IRA appealing. “These individuals can keep contributing during corrections without being forced to sell.”

Investors worried about long-term fiat debasement could also be a good fit, as Comair commented that Bitcoin’s fixed supply and institutional adoption make it a strategic hedge for retirement portfolios that are otherwise concentrated in assets tied to central bank policy.

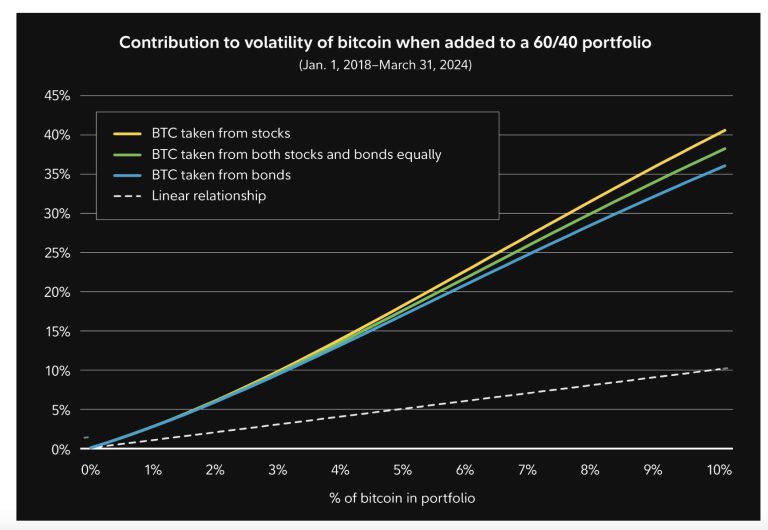

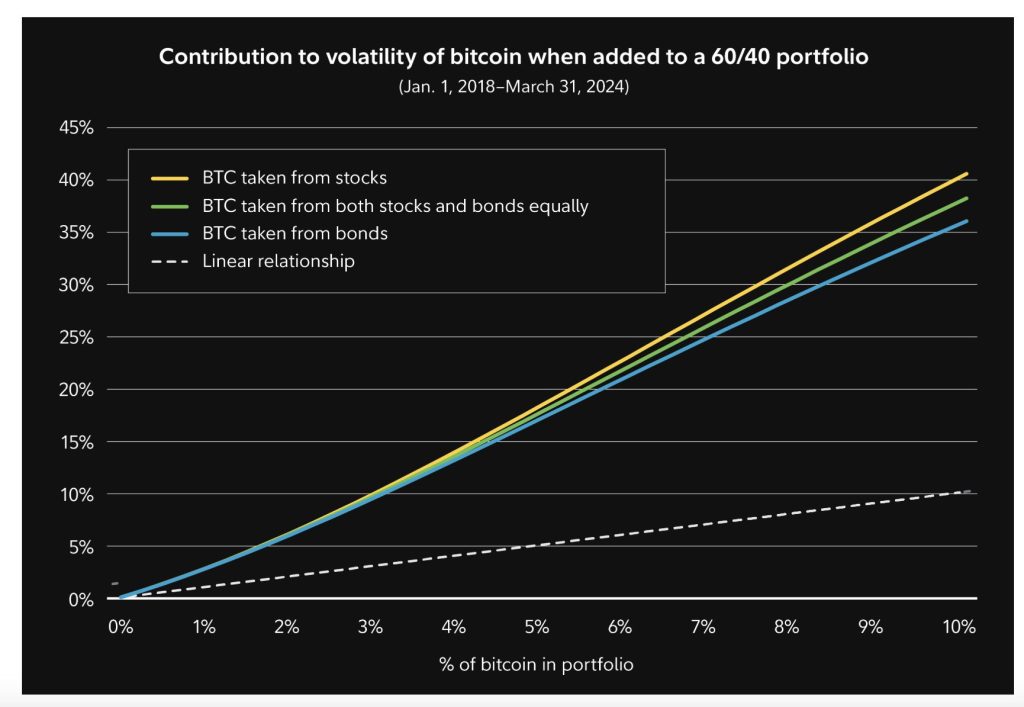

However, investors who are more cautious or close to retirement and cannot tolerate large swings may want to rethink having a Bitcoin IRA. Fidelity research found that adding BTC to a portfolio would have enhanced returns during specific periods in the past, but also that even a small allocation of Bitcoin meaningfully increased portfolio volatility.

The Future Growth of Bitcoin IRAs

As the broader crypto market matures, demand for Bitcoin IRAs appears set to accelerate. Rose said BlockTrust is already seeing increased interest from international investors seeking exposure through U.S.-based Bitcoin IRAs.

Comair believes this trend is only just beginning. He predicts that by 2026, Bitcoin will sit “much closer to the center of retirement strategies.”

“Exchange-traded fund penetration will be broader, corporate ownership more common, and the post-halving supply regime will be tighter. For retirement investors, this period will be remembered as the phase when buying dips in a structurally appreciating asset became standard practice, not a contrarian move.”