The crypto market is down today, with not a single green coin over the past 24 hours. The cryptocurrency market capitalization has decreased by another 7.3% to $3.83 trillion. At the same time, the total crypto trading volume is at $163 billion.

TLDR:

Crypto Winners & Losers

All top 10 coins per market capitalization have decreased over the past 24 hours.

Bitcoin (BTC) fell by 2.3% in a day and below the $116,000 mark, now trading at $115,555.

At the same time, Ethereum (ETH) decreased by 4.8%, now changing hands at $3,673.

The highest drop is 7.5% by Dogecoin (DOGE), which currently changes hands at $0.2061.

It’s followed by Solana (SOL)’s 6.5% to the price of $169.

The smallest drop in this category Tron (TRX)’s 03%, changing hands at $0.3254.

As for the top 100 coins, five coins recorded double-digit decreases. SPX6900 (SPX) fell the most: 16.3% to $1.64.

Ethena (ENA) follows with an 11.8% drop to the price of $0.5732.

Jupiter (JUP), Pudgy Penguins (PENGU), and Bonk (BONK) also saw double-digit falls.

Additionally, according to onchain data firm CryptoQuant, on 31 July, Bitcoin saw its third major profit-taking spike in this bull run.

The markets across the board are reacting to the unchanged interest rate by the US Federal Reserve, while the investors keep an eye on the inflation data. Overall, the increased tariff fears amid the ongoing trade deal saga in the US are pulling the prices down.

Douglas Colkitt, Initial Fogo Contributor, commented that “the dissenting voices at the Fed are a big deal. It’s rare – and it tells you there’s serious internal debate about how long the Fed can hold this line without breaking something. For crypto, that uncertainty is fuel. When confidence in policy coherence starts to erode, decentralized assets look a lot more attractive.”

Mike Cahill, CEO of Douro Labs, a contributor to the Pyth Network, added that, “in that kind of regime, assets with asymmetric upside and low policy correlation – like Bitcoin – start to play a more strategic role. We’re seeing capital rotate not just for yield, but for resiliency in a fractured macro backdrop.”

‘46% Chance BTC Hits $150,000 by Year’s End’

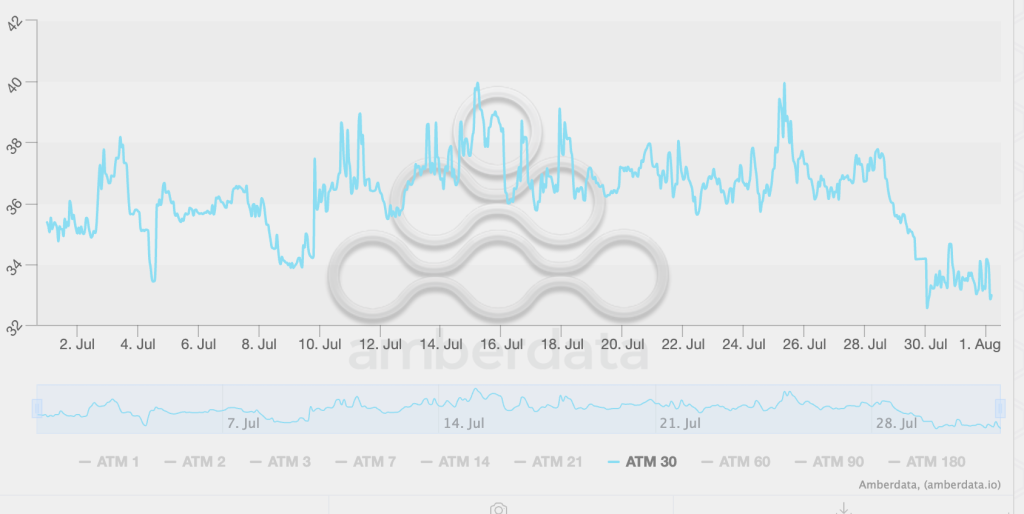

Nick Forster, Founder of the decentralized onchain options AI-powered platform Derive.xyz, commented that 30-day BTC volatility has decreased from 36% to 34% in July, “suggesting the early stages of volatility compression. However, storm clouds are forming as tariff negotiations and renewed concerns about Fed independence loom over markets.”

BTC 30-day volatility over the last month:

There is some 30% chance of BTC reverting to $100,000 before the end of September. Also, the chance of ETH falling to $3,000 in that time is about 35%.

On the other hand, there is a 46% chance BTC hits $150,000 and a 12% chance it reaches $200,000 before the end of the year.

Moreover, the 30-day volatility gap between ETH and BTC increased from 24% to 30% in July. “ETH is expected to remain more volatile, likely reflecting renewed investor interest following its 10th birthday and the rise of ETH treasury companies such as Ethermachine and Bitmine,” Forster says.

James Toledano, Chief Operating Officer at Unity Wallet, added that in the near term, Bitcoin could continue to trade sideways as markets absorb macroeconomic signals. But “a rise in inflation expectations or renewed institutional inflows could provide the momentum needed for another push toward its previous high and possibly even a new all‑time high.”

He continued: “When the Fed holds rates steady, it usually supports Bitcoin by preserving liquidity and maintaining a favorable environment for risk assets. While this doesn’t guarantee an immediate price surge, it does remove a key bearish catalyst. Given Bitcoin’s recent run-up, I expect the price reaction to be relatively muted in the short term – though I’d be happy to be proven wrong.”

Also, Charley Cooper, Chief Operating Officer at Ava Labs, said that “it’s no surprise that the Federal Reserve kept rates unchanged. From a macro perspective, they’re waiting for what they believe is the right opportunity to cut rates. Whenever that comes, it will be bullish for crypto.”

He added that it’s realistic to assume that “later this year we should get a rate cut or two, which will be great for crypto.”

“Crypto investors in the early days thought they had divorced themselves from the financial system,” Cooper says. “Over time, we’ve increasingly seen that as crypto becomes more mainstream, it’s increasingly impacted by some of the same macro factors that other asset classes are.”

“The policy decisions out of Washington, whether economic, trade, monetary, are having more of a direct impact on crypto, and those of us in the crypto markets have to pay attention to the same things that we probably didn’t have to pay attention to in the early days.” Cooper concludes.

Levels & Events to Watch Next

At the time of writing on Thursday morning, BTC trades at $115,555. It fell sharply from $118,696 and below the $115,000 mark to $114,980. It recovered somewhat since.

The coin may still fall further below this level, possibly into the $113,000 zone. Alternatively, should the bull return, it could rise back towards the $118,696.

Also, Ethereum is currently trading at $3,673. It initially climbed to the price of $3,874, nearing the $4,000 mark. However, it then plunged to $3,653.

Like BTC, ETH recovered slightly since the daily low, but can still go lower should the dip continue, possibly to the $3,640 level.

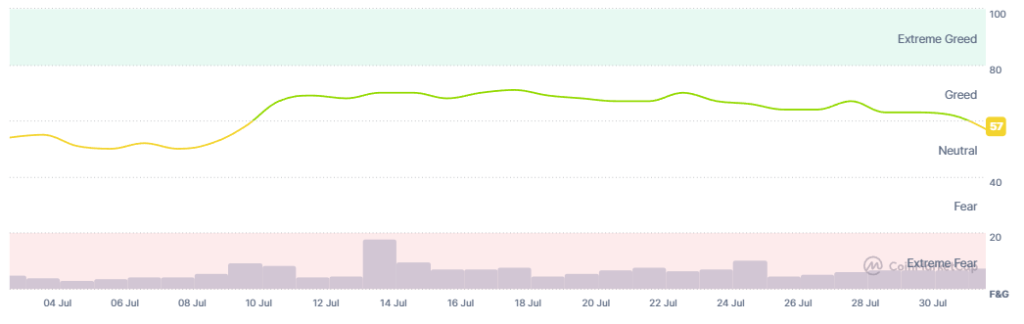

Meanwhile, after several days of hovering at the edge of the greed zone, the crypto market sentiment has dropped into the neutral area. The crypto fear and greed index stands at 57 today compared to 62 yesterday.

A slight fear has crept into the market, and should the prices and the sentiment drop further, it may open buying opportunities.

Furthermore, on Wednesday, the US BTC spot exchange-traded funds (ETFs) recorded outflows, breaking a streak again. It lost $114.83 million.

Of the five funds that saw inflows, BlackRock took in the most: $18.62 million. At the same time, three funds saw outflows, the highest of which is Ark&21Shares’ $89.92 million.

At the same time, the US ETH ETFs broke the record with the 20th consecutive day of positive flows. The inflows stood at $17 million on Thursday.

BlackRock took in $18.18 million, and Fidelity saw inflows of $5.62 million. On the other hand, Grayscale was $6.8 million in the red.

Crypto exchange Coinbase bought 2,509 BTC in Q2 2025 and said it would increase its Bitcoin holdings. With this latest purchase, Coinbase became one of the top 10 public companies that hold Bitcoin, overtaking Tesla.

Moreover, Strategy has launched a new $4.2 billion at-the-market (ATM) equity program for its STRC preferred shares. The STRC program allows the company to raise capital over time. A portion of the proceeds is expected to be allocated for additional Bitcoin purchases.

Meanwhile, the US House Committee on Financial Services Chairman French Hill has urged the Senate to pass key digital asset legislation. “Now that the GENIUS Act is law and the CLARITY Act received overwhelming bipartisan support in the House, the Senate must expeditiously work to deliver such critical market structure legislation to President [Donald] Trump’s desk,” Hill said.

Quick FAQ

- Why did crypto move with stocks today?

Both the crypto and the stock market fell over the last day. The S&P 500 was down by 0.37%, the Nasdaq-100 increased by 0.55%, and the Dow Jones Industrial Average fell by 0.74%. This comes as the US Federal Reserve decided to keep the interest rate unchanged, as investors focus on the inflation data and the tech companies’ financial reports.

- Is this dip sustainable?

In the short term, the prices may drop further. For now, the dip doesn’t seem to be long-lasting, but the future outcome will depend on the incoming economic signals.