The crypto market has seen a minor and expected pullback. Most of the top 100 coins per market cap have decreased over the past day. At the same time, the cryptocurrency market capitalization has decreased 2.3% over the past day, currently standing at $3.55 trillion. The total crypto trading volume is at $100 billion.

TLDR:

Crypto Winners & Losers

At the time of writing, only three of the top 10 coins per market capitalization have appreciated over the past day. Ethereum (ETH) appreciated just 0.2%, meaning it’s mostly unchanged over the past day. It’s now changing hands at $2,585. Its daily high is $2,720.

Tron (TRX) and Binance Coin (BNB) are up 1.5% and 0.8% to $0.276 and $679, respectively. Speaking of BNB, there’s a report that whales have been shorting BNB faster than retail investors. This may be a bear trap. Whales may push the price higher to trigger a large volume of stop orders, leading to a significant short-term increase for BNB.

At the same time, Bitcoin (BTC) decreased by 0.6%, now trading at $109,181. The coin hit its all-time high of $111,814 on 22 May, falling 2.4% since. This is a pullback from the intraday high of $111,807, just a few dollars shy of a new ATH.

At the same time, XRP recorded the highest loss: 2.2% to the price of $2.3.

Of the top 100 coins, only 12 recorded price increases today. Quant (QNT) is the highest gainer and the only one with a double-digit increase. It’s up 10.2% to $106.1.

Monero (XMR) fell the most in this category. It’s down 6% to the price of $392.

Importantly, the crypto market is still highly influenced by the macroeconomic developments. And macro uncertainty currently grows. James Toledano, Chief Operating Officer at Unity Wallet, argues that Bitcoin’s inherent volatility remains a significant concern. Its price is susceptible to rapid fluctuations due to market sentiment, regulatory changes, and macroeconomic shifts, he says.

Notably, many analysts have been warning over the past few days that a correction is possible. A short-term pullback tends to follow period of rapid gain. Following a strong rally we saw over the past few days, investors may be capitalizing on profits. This behavior results in short-term sell-offs.

There are also some discussions about potential regulatory measures in major markets, which we’ll discuss below. Investors may be more cautious at the moment.

10% Chance for BTC to Surpass $130,000

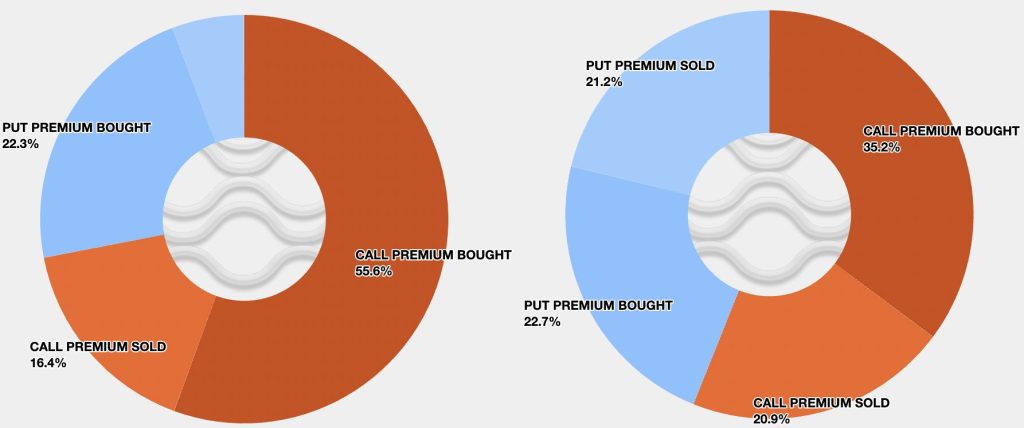

Nick Forster, Founder of decentralized onchain options AI-powered platform, Derive.xyz, commented that the rally has stalled slightly. Volatility for BTC and ETH has stayed consistent, at 45% and 72%, respectively.

There’s a 10% chance of BTC surpassing $130,000 by the end of June. ETH has a 15% chance of exceeding $3,100 in the same time.

Looking forward, “short-term, traders are anticipating a move upwards, evidenced by a large buy-up of calls on the $112,000 BTC strike for May 30,” Forster says. “However, expectations for BTC to remain below $110,000 by June 27 are also building, with a significant number of calls sold for that expiry.”

Moreover, market makers remain short gamma, the founder says. As BTC and ETH rise, market makers are forced to buy more to hedge, potentially triggering a short-term price spike.

BTC traders on Derive.xyz are positioning for a move upward, Forster added. They’re also capitalizing on cheap volatility.

“Over the past 24 hours, 55.6% of premiums traded were calls bought, with 22.3% puts purchased. For ETH, the distribution is more balanced, suggesting a more uncertain outlook and fairly priced volatility,” he concluded.

Levels & Events to Watch Next

After hitting the all-time high of $111,814 last Thursday, BTC briefly hit an intraday high of $111,807, and then recorded a pullback to $109,181.

Key resistance levels currently stand at $109,653, $111,935, and $113,300. Support levels are $108,731, followed by $107,078. Should it fail to hold the latter level, BTC may fall to $105,905.

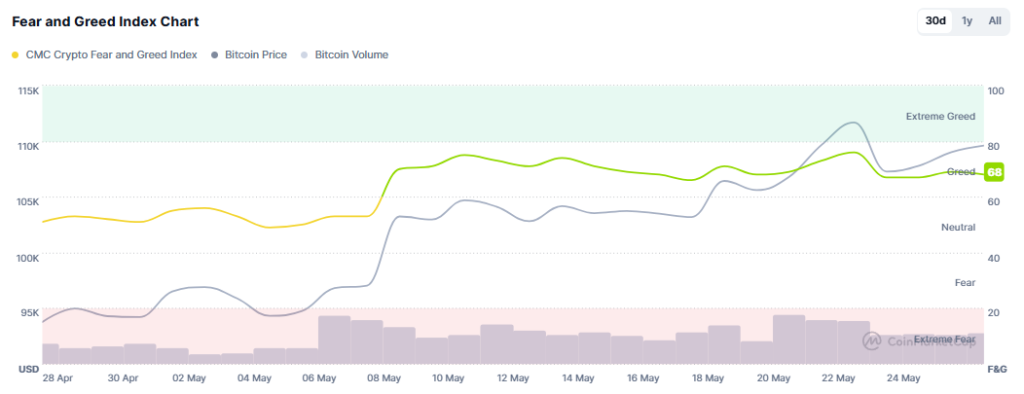

Notably, the Fear and Greed Index has seen a slight decrease from 69 to 68. So, it’s still very much in the green territory, signaling ongoing bullishness, overall a positive sentiment, and a general willingness to take risks

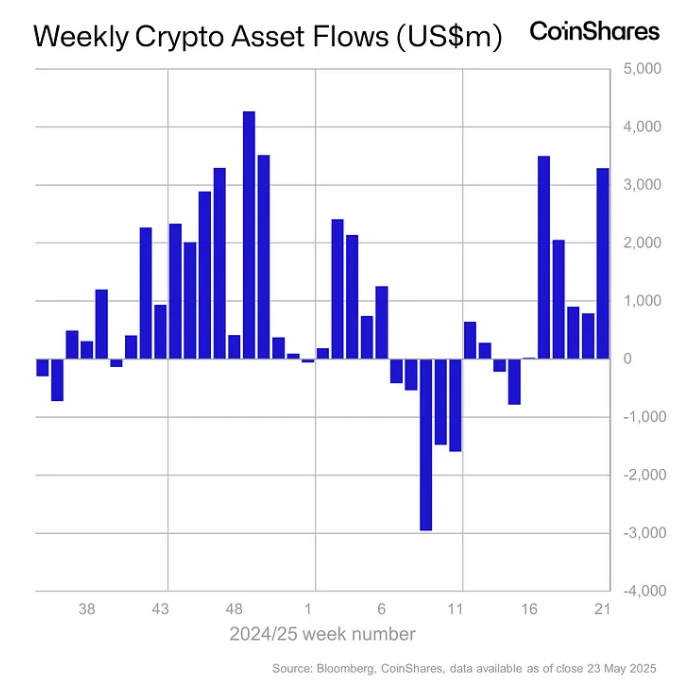

Moreover, there is currently no data on the US spot Bitcoin ETFs flow for today. However, the CoinShares report found that digital asset investment products saw inflows of $3.3 billion last week. This has extended the six-week streak to $10.5 billion. Also, year-to-date inflows hit a new record of $10.8 billion.

Meanwhile, there are some red flags to keep an eye on. Reportedly, Trump Media & Technology Group plans to raise a whopping $3 billion to buy digital assets, including BTC. Importantly, this company operates the Truth Social site, and both are under the control of the US President Donald Trump’s family – and, allegedly, Trump himself. His involvement in the crypto industry, however, keeps raising ethical and regulatory concerns. This may have an effect on the crypto market.

At the same time, in India, the crypto sector is reportedly lobbying for a rollback of 2022 tax rules, which chased more than 90% of crypto trading outside of the country.

Moreover, in Thailand, the Securities and Exchange Commission (SEC) has restricted its tokenized government bonds, G-Token, from being used as a means of payment. In France, Blockchain Group plans to buy an additional $72 million worth of Bitcoin following a successful $71.85 million bond sale.

Quick FAQ

- Why did crypto move with stocks today?

After several days of crypto trading against stocks, both are trading down today. The S&P 500 is down 0.67%, the Nasdaq-100 decreased by 0.93%, and the Dow Jones Industrial Average fell 0.61%. Crypto’s drop seems to be a typical market correction, rather than a reaction to the stock market drop.

- Is this dip sustainable?

Based on the factors noted above, today’s dip doesn’t seem alarming. It’s rather common for the volatile market. Additionally, the global market capitalization remains strong, suggesting sustained investor interest.