The crypto market is down today, with the cryptocurrency market capitalisation decreasing by 1%, now standing at $3.63 trillion. A large majority of the top 100 coins have dropped over the past 24 hours. At the same time, the total crypto trading volume is at $199 billion.

TLDR:

Crypto Winners & Losers

At the time of writing, 9 of the top 10 coins per market capitalization have seen their prices decrease over the past 24 hours.

Bitcoin (BTC) has dropped by 1% since this time yesterday, currently trading at $105,168.

Ethereum (ETH) is down by 1.3%, now changing hands at $3,558.

The highest drop in the category is 2.7% by Binance Coin (BNB), which trades at $977.

It’s followed by Dogecoin (DOGE)’s 2% to the price of $0.1771.

When it comes to the top 100 coins, six saw double-digit drops. Two of these are in the 20% zone. Canton (CC) fell 27.1% to $0.1111, while Zcash (ZEC) is down 26.6% to $489.

At the same time, Uniswap (UNI) is the only coin to record a double-digit rise, with an increase of 24.8%, now standing at $8.43.

Despite today’s minor drop, there is room for investor confidence. Market optimism has been rising around Nasdaq and Cboe’s entry into regulated crypto trading.

Also, the US Senate has passed a bill late Monday to reopen the government after the longest shutdown on record. Given that the shutdown tightened liquidity and increased volatility, the reopening is expected to be positive for crypto.

Large Sums of Idle Capital May Be Coming Back

Bitunix analysts commented that, although the US government reopening bill awaits final approval, “expectations of renewed liquidity have immediately lifted market sentiment.” Large sums of idle capital could soon return to circulation and reinvigorate risk assets, the comment says.

They write that “the turning point in the government shutdown offers a rare “liquidity window.” If the crypto market can seize this moment, a phase of sectoral rotation may follow. Nonetheless, non-major tokens and leveraged positions still face the challenge of cautious capital reallocation.”

The “implications are significant” for the crypto market:

- the return of liquidity is likely to strengthen capital absorption for regulated majors such as BTC and ETH;

- if regulatory agencies resume normal operations, the approval process for crypto ETFs and similar instruments could accelerate – this could create new entry opportunities for institutional capital.

That said, should there be a delay in approval or intensified regulatory review after the reopening, the renewed optimism could be dampened.

Meanwhile, Kraken’s Global Economist, Thomas Perfumo, noted that in a matter of days, Bitcoin’s circulating supply will cross 19.95 million coins, or 95% of its max supply.

“In the short term, Bitcoin’s market price fluctuates with macro conditions that drive global markets, business cycles, liquidity trends, and investor sentiment,” Perfumo says. “Over the long term, we believe Bitcoin’s hard money design, coupled with permissionless access and growing adoption, drive value accrual to the network.”

Levels & Events to Watch Next

At the time of writing on Tuesday morning, BTC trades at $105,168. The trading was quite choppy over the past day, ranging between $104,768 and $107,357.

BTC is currently 16.6% away from its all-time high of $126,080.

Should the price move above $108,200 and hold that level, it could continue toward $111,000 and $113,000. A drop below $105,300 could lead to $104,000, followed by a move towards $100,000.

Ethereum is currently changing hands at $3,558. Over the past day, it has moved in a relatively tight range between the intraday low of $3,512 and the intraday high of $3,640.

The coin is now up 1.2% in a week and down 7.5% in a month.

Ethereum’s chart is overall bullish. If it breaks above $3,800, it could aim for the $4,200–$5,000 range. Conversely, dropping below $3,400 could lead further to $3,150.

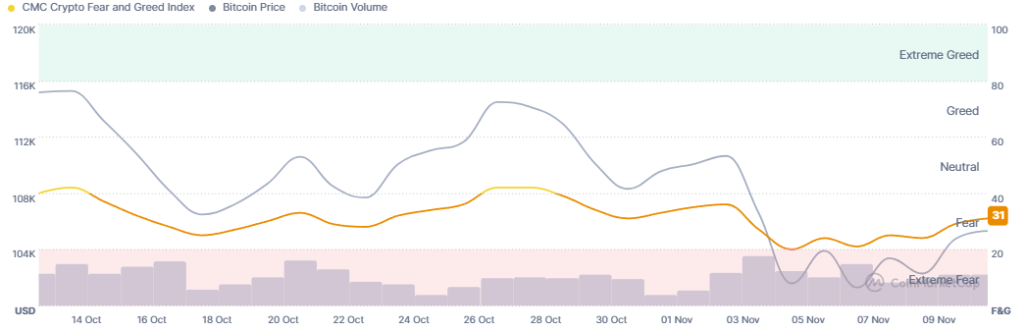

Moreover, the crypto market sentiment has increased, though it has stayed within the fear zone. The crypto fear and greed index stands at 31 today, compared to 24 this time yesterday.

Though investors remain highly cautious, there are signals for potential incoming bullish sentiment should volatility ease upon beneficial economic and geopolitical factors.

ETFs See Minimal Flows

On Monday, the US BTC spot exchange-traded funds (ETFs) recorded $1.15 million in inflows. The total net inflow is largely unchanged since Friday, standing at $59.97 billion.

This entire amount is taken by only one of the 12 BTC ETFs – Bitwise. There were no outflows.

On the other hand, the US ETH ETFs saw no flows on Monday. The total net inflow still stands at $13.86 billion.

Of the nine funds, none recorded positive or negative flows.

Notably, large Ethereum holders seem to be increasing their exposure as prices consolidate. Whales have added 7.6 million ETH since late April, a 52% rise in total holdings. Per analysts, this is a pattern that often preceded major reversals in past cycles.

Meanwhile, the US Commodity Futures Trading Commission (CFTC) is preparing to allow leveraged spot cryptocurrency trading on regulated fiat exchanges as early as next month.

Quick FAQ

- Why did crypto move against stocks today?

The crypto market has decreased slightly over the past day, while the stock market surged on Monday. By the closing time on 10 November, the S&P 500 was up by 1.54%, the Nasdaq-100 increased by 2.2%, and the Dow Jones Industrial Average rose by 0.81%. The investor optimism jumped following the news of a deal that would end the record US government shutdown.

- Is this drop sustainable?

The current drop may not last. Following the latest macroeconomic and geopolitical developments, we could see market volatility easing and liquidity flowing. With that, the crypto market would likely to see another increase. Its sustainability, however, will depend on how lasting these effect will be.