The crypto market is down today, with the cryptocurrency market capitalization decreasing by 0.5%, and back below the $4 trillion mark, now standing at $3.99 trillion. About 80 of the top 100 coins have dropped over the past 24 hours. At the same time, the total crypto trading volume is at $146 billion.

TLDR:

Crypto Winners & Losers

At the time of writing, five of the top 10 coins per market capitalization have decreased over the past 24 hours, and three are up (not taking the two stablecoins into account).

Bitcoin (BTC) fell by 0.4% at the time of writing, meaning that it’s mostly unchanged, currently trading at $112,381.

Ethereum (ETH) is down by 0.7%, now trading at $4,327.

The highest decrease is XRP’s 1.3%, currently standing at $2.98.

Solana (SOL) is the winner on this list. It appreciated 1.5%, changing hands at $222.

The other two green coins are Dogecoin (DOGE) and Binance Coin (BNB), having gone up 0.5% and 0.2%, respectively.

When it comes to the top 100 coins, about 80 are down at the time of writing.

The highest among these is World Liberty Financial (WLFI)’s 9.5% to $0.1991.

It’s followed by Sky (SKY)’s 7.7% to $0.07029. The rest are down 4% and below.

On the other side, Provenance Blockchain (HASH) and Story (IP) are two of the four coins that recorded double-digit increases. They’re up 33.1% and 20.7% to the prices of $0.03706 and $10.4.

Meanwhile, Nasdaq has committed $50 million to Gemini in a private placement just days before the exchange’s IPO. Gemini plans to raise some $317 million by selling 16.67 million shares at $17–$19 each. It aims for a valuation of up to $2.2 billion.

‘The Market is Nearing a Breakout Point’

Analysts from Glassnode commented that now “the focus shifts from the breakout itself to what follows after compression breaks.”

They have found that BTC is now testing a key zone, and the deciding factor will be the momentum.

All short-term annualized Realized Volatility metrics have dropped below 30%. This marks a low-volatility regime since the $107,000 bottom, they said. However, “such calm rarely lasts, volatility spikes tend to follow. The market is nearing a breakout point, with momentum ready to shift.”

That said, the drop to the $107,000 triggered fear-driven selling from top buyers, Glassnode said. This formed a “textbook setup for local bounce-backs.”

“A short-term rally toward $114,000 is likely, but as long as price trades below that level, the broader bias leans toward bearish continuation,” the analysts concluded.

Levels & Events to Watch Next

At the time of writing on Wednesday morning, BTC trades at $112,381. Earlier in the day, the coin dropped from the high of $113,138 to the day’s lowest point of $110,822.

If the price holds above $111,500, the price could continue climbing toward $115,400 and $117,150, and then to $125,000 in the medium term.

However, losing the $111,000 level could take the price back to $110,000 and $108,450.

Ethereum is currently trading at $4,327. Like BTC, ETH too fell sharply from the intraday high of $4,365 to the intraday low of $4,280, before recovering somewhat to the current price.

It’s currently 12.5% away from its all-time high of $4,946, recorded 17 days ago.

Investors are now looking to see if the price will hold above $4,300, which could see it rise towards $4,500. Conversely, it could fall below $4,150.

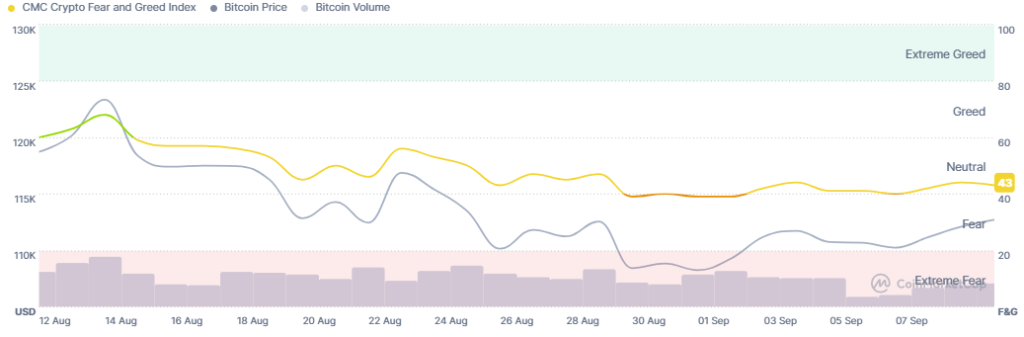

Meanwhile, the crypto market sentiment has been moving within a tight range and within the neutral zone over the past several days.

The crypto fear and greed index fell slightly from 44 yesterday to 43 today.

It’s clear that investors are quite cautious and are waiting for further signals to decide how to react in the near and long terms.

Moreover, the US BTC spot exchange-traded funds (ETFs) saw minor positive flows on 9 September of $23.05 million. One ETF saw inflows, and three saw outflows.

BlackRock is up $169.31 million, while Ark&21Shares is down $72.29 million.

After several days of outflows, the US ETH ETFs recorded inflows on Tuesday of $44.16 million.

The entire amount came from a single fund: BlackRock. There were no other flows.

Meanwhile, Nakamoto, a subsidiary of KindlyMD, has committed up to $30 million to join Metaplanet’s global equity offering. This is the firm’s largest investment to date.

On Monday, the firm announced the acquisition of an additional 136 BTC for $15.2 million, bringing its total to 20,136 BTC.

Moreover, QMMM Holdings, a Hong Kong-based digital media advertising firm, has reported a 1,736% increase in stock soon after it announced plans to build a $100 million crypto treasury targeting Bitcoin, Ethereum, and Solana.

In other news, Vietnam has approved a five-year pilot for cryptocurrency trading. The resolution allows Vietnamese companies to operate platforms, issue tokens, and sell them, but only to foreign investors. All issuance, trading, and payments must be settled in local dong.

Quick FAQ

- Why did crypto move against stocks today?

The crypto market has decreased over the past day, while the stock market went up on its previous day of trading. By the closing time on Tuesday, the S&P 500 was up by 0.27%, the Nasdaq-100 increased by 0.33%, and the Dow Jones Industrial Average rose 0.43%. This comes amid expectations that the US Federal Reserve is set to cut interest rates at the policy meeting planned for next week.

- Is this dip sustainable?

The market is consolidating, and we may see additional minor increases and decreases in the near term. Additional geopolitical and economic signals will affect the price trajectory over the mid to long term.