After a single day of pullbacks, the crypto market is up today again. 92 of the top 100 coins per market cap have seen their prices appreciate over the past 24 hours. Meanwhile, the cryptocurrency market capitalization has decreased by 2.1% to $3.8 trillion. The total crypto trading volume is at $205 billion, a similar level to yesterday’s.

TLDR:

Crypto Winners & Losers

At the time of writing, all the top 10 coins per market cap have increased.

Bitcoin (BTC) is up 1.1%, rising back above the $117,000 level, currently trading at $118,233.

Also, Ethereum (ETH) saw the highest increase in this category. It’s up 5.8% to the price of $3,145.

Dogecoin (DOGE)’s 3.3% is the second-highest increase. It now trades at $0.1974.

Tron (TRX) increased the least. It’s up 0.4% to $0.3008.

In the top 100 coins category, Pump.fun (PUMP) appreciated the most. It’s up 11.2% to $0.006593. This is the only double-digit rise.

Artificial Superintelligence Alliance (FET) is next, having gone up by 9.8% to the price of $0.7578.

Fartcoin (FARTCOIN) fell the most among the eight red coins. It’s down 4.6%, changing hands at $1.2.

Next up is WhiteBIT Coin (WBT), which decreased by 2.1% to $44.31.

Meanwhile, several pieces of crypto legislation in the US failed to move through Congress on Tuesday. A group of House Freedom Caucus politicians voted against the bills, arguing that, among other things, the crypto bills did not sufficiently address problems surrounding central bank digital currencies (CBDCs), along with other concerns.

The Moscow Exchange said it would launch a fund that tracks one of the world’s biggest Ethereum ETFs, weeks after debuting a Bitcoin index futures offering. The new fund will debut in August.

Maria Patrikeyeva, the Managing Director of the Moscow Exchange Derivatives Market, said that “The fund’s underlying asset will be the BlackRock-run iShares Ethereum Trust ETF. Its quotation will be equal to the cost of one share of the fund. The contract size will be slightly smaller than [that we use for the] IBIT [the iShares Bitcoin Trust ETF].”

Could Bitcoin Reach $150,000 Soon?

Andrejs Balans, risk manager at the EU-based fintech platform YouHodler, commented that Bitcoin’s market has “matured considerably.” It’s seeing improved liquidity and participation by professional trading firms.

This evolution, Balans argues, has lowered volatility compared to past cycles. This signals a more resilient market. However, it’s also “a factor that can dampen large speculative moves.”

“Following significant gains this year, many long-term holders have realized profits, thereby adding to the market’s supply. Without sustained fresh demand, this selling pressure could keep prices range-bound rather than driving a decisive breakout.”

Moreover, institutional exposure has increased through ETFs and custody services, Balans says. And yet, most allocations remain modest relative to traditional asset classes. The obstacles to more substantial commitments include concerns about volatility, operational risk, and compliance.

“Senior executives at major banks have reiterated their cautious stance, describing crypto as an area of interest but not yet a strategic priority. Without a broad shift in institutional sentiment, it is unlikely that inflows alone will propel Bitcoin to $150,000 swiftly.”

Furthermore, Balans adds that some regulatory frameworks have advanced, but that the policy landscape remains fragmented. Proposals to broaden the definition of securities in the US and stricter compliance regimes in Europe have created uncertainty for exchanges and institutional investors.

He continues: Even jurisdictions considered relatively crypto-friendly are implementing more rigorous reporting standards. This patchwork of regulation has tempered enthusiasm among large asset managers, who prefer clear and consistent rules before committing significant capital.

Lastly, Balans noted that “despite widespread forecasts of imminent rate cuts, inflation in major economies remains persistently above target, prompting central banks to hold policy rates higher for longer.” The tight monetary environment has limited liquidity across risk assets. Bitcoin has historically “flourished when borrowing costs were low and capital abundant.”

“Unless there is a decisive shift toward more favorable financial conditions, the macroeconomic backdrop is likely to constrain speculative flows,” Balans concludes.

Levels & Events to Watch Next

At the time of writing, BTC trades at $118,233. The coin saw quite a choppy trade over the past day. The lowest level it reached was $116,103, to which it dropped from the intraday high of $118,315.

It’s currently approaching the previous intraday high and may surpass it soon.

Moreover, Ethereum is currently trading at $3,145. Unlike BTC, ETH saw a gradual rise to the current level. It started at $2,965 as its intraday low and rose to the current price, which is also the intraday high.

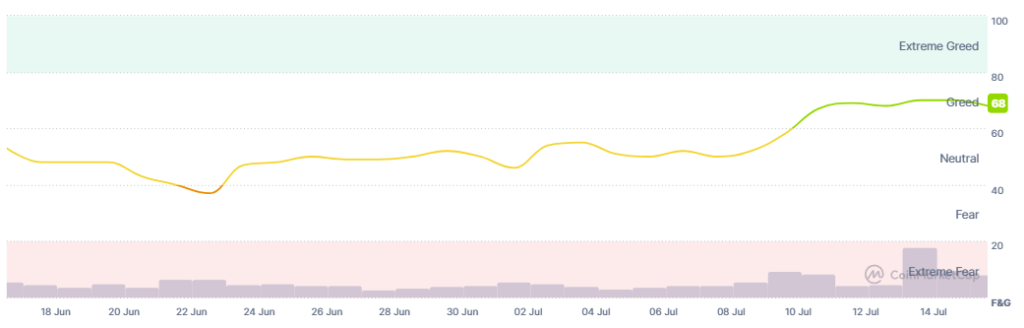

Meanwhile, the crypto market sentiment dropped slightly since this time yesterday, but it still remained in greed territory. The Fear and Greed Index decreased from 70 yesterday to 68 today.

The level signals investors’ positive and optimistic view of the market, as well as a generally high willingness to invest. However, should it increase, it may indicate that the market is overbought.

Furthermore, on 15 July, the US BTC spot exchange-traded funds (ETFs) saw positive flows for the ninth day in a row. They recorded inflows of $402.99 million, higher than $297 million from the day before and lower than $1.03 billion seen two days before.

BlackRock saw the highest share of this amount, taking in $416.35 million. While Grayscale, Bitwise, VanEck, and Franklin also saw inflows, others recorded outflows.

US ETH ETFs also saw inflows for the eighth day in a row, with $192.33 million on 15 July.

Of this amount, BlackRock recorded the most: $171.52 million. Grayscale and Fidelity are the only other two funds that saw inflows. There were no outflows on this day.

Meanwhile, SharpLink has continued buying ETH. It purchased 6,377 ETH on Wednesday, bringing its total to nearly 312,000 ETH.

Also, billionaire Peter Thiel has taken a major position in BitMine Immersion Technologies as it works to become a major Ethereum treasury. He acquired a 9.1% stake in the firm. The company now holds more than 163,000 ETH.

Moreover, Wall Street investment bank Cantor Fitzgerald and Blockstream Capital founder Adam Back are reportedly working on a SPAC merger valued at approximately $4 billion. A special-purpose acquisition company would issue new shares to Back for 30,000 BTC. The company also aims to raise $800 million in outside capital to buy more BTC.

Quick FAQ

- Why did crypto move against stocks today?

The crypto market has increased over the past 24 hours, while the US stock market saw a mixed performance by closing time on Tuesday. For example, the S&P 500 is down by 0.4%, the Nasdaq-100 increased by 0.13%, and the Dow Jones Industrial Average fell by 0.98%. The stock investors are still digesting the latest tariff threats coming from the US and are waiting for this week’s earnings reports and economic data.

- Is this rally sustainable?

Analysts argue that there is room for further growth in the mid and long term. Despite the expected pullbacks and corrections, the market is still expected to rise.