The crypto market is up today again, with the cryptocurrency market capitalization rising by 1.5% to $4.12 trillion. 90 of the top 100 coins have increased over the past 24 hours. At the same time, the total crypto trading volume is at $168 billion.

TLDR:

Crypto Winners & Losers

At the time of writing, all top 10 coins per market capitalization have increased over the past 24 hours.

Bitcoin (BTC) appreciated another 1.1% at the time of writing, currently trading at $115,350. This is the smallest increase in the category.

Ethereum (ETH) is up by 2.3%, now trading at $4,548. It’s the third-best gainer in the category.

The best performer is Solana (SOL), which is up 7.1%, now trading at $238.

It’s followed by Dogecoin (DOGE), having gone up 4.8%, currently standing at $0.2617.

When it comes to the top 100 coins, 92 are up at the time of writing. One of these recorded a double-digit increase. Provenance Blockchain (HASH) is up 29.9% to $0.04028.

Pudgy Penguins (PENGU) follows with 9.6%, trading at $0.03791.

On the red side, MYX Finance (MYX) fell by 10% to $15.35.

It’s followed by Worldcoin (WLD)’s 2.8% drop to $1.71.

Notably, Gemini Space Station’s initial public offering (IPO) saw $425 million late Thursday, becoming one of the strongest debuts for a digital asset platform. The IPO was reportedly over 20 times oversubscribed.

‘Smart Money Rotating Back Into BTC’

Nick Forster, founder at on-chain options platform Derive.xyz, noted that the markets spiked on the expected news of 2.9% US CPI data. However, they “quickly cooled before reverting to broader trends. Still, the print signals inflationary pressure may be creeping back in, particularly under the weight of new tariff regimes.”

That said, both BTC and ETH have increased “despite the brief CPI-induced turbulence.”

Under the surface, Forster writes, “ETH’s implied volatility has hit multi-week lows across the board. The current term structure shows compressed pricing for all expiries, a classic sign that the market is entering a volatility contraction. Historically, these don’t last long. When vol expands again, it tends to do so sharply.”

On the other hand, ETF flows are showing a divergence, he says. ETH inflows “have slowed considerably,” and BTC institutional buying spiked. “The smart money appears to be rotating back into BTC, possibly taking a breather from ETH beta after its recent run.”

Meanwhile, the probability of BTC hitting $125,000 by the end of October has jumped from 40% to 52%, while the chance of ETH hitting $6,000 in the same period fell from 23% to 19%.

Levels & Events to Watch Next

At the time of writing on Friday morning, BTC trades at $115,350. Over the last 24 hours, the coin saw movement between the low of $113,496 and the high of $116,309, dropping slightly to the current level.

The coin is now just 7.1% away from its all-time high of $124,128 recorded 29 days ago.

Bitcoin is consolidating near $114,497. A firm move above $115,411, the price could continue climbing further to $117,150 and $118,617.

A drop below that level could lead to a pullback to $113,000 or $110,000.

Ethereum is currently trading at $4,548. For most of the last 24 hours, it traded around the low of $4,392. It then surged to the intraday high of $4,558.

It’s now down 8.4% from the ATH of $4,946. It’s up 4.6% in a week and down 2.2% in a month.

ETH could continue climbing towards its ATH. A breakout above $4,600 could lead to $4,750 and $4,900. On the other hand, it may slide back to $4,400 and $4,200.

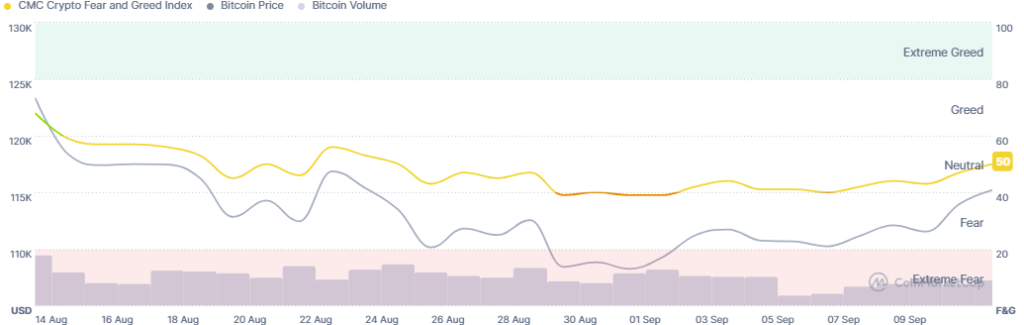

Meanwhile, the crypto market sentiment has seen another increase within the neutral zone over the past day. The crypto fear and greed index went up from 47 yesterday to 50 today. This is also a rise from 40 since the beginning of this year.

This indicates persistent healthy caution among investors, but also a continual rise in bullish sentiment.

Moreover, the US BTC spot exchange-traded funds (ETFs) recorded another day of inflows on 11 September of $552.78 million. The cumulative net inflow has reached $56.19 billion.

Six of the 12 ETFs saw inflows, and there were no outflows. BlackRock is up by $366.2 million, while Fidelity recorded positive flows of $134.71 million.

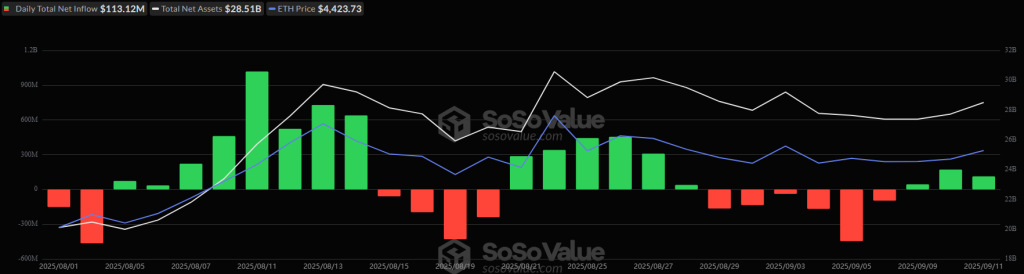

Additionally, the US ETH ETFs recorded inflows on Thursday of $113.12 million. Five of the nine funds saw inflows, and one saw outflows. The total net inflow is now at $12.96 billion.

Of this, Fidelity saw the highest green amount of $88.34 million, while BlackRock let go of $17.39 million.

Meanwhile, bankrupt crypto firms FTX and Alameda have withdrawn approximately 192,000 SOL, worth around $44.9 million. The estate has been redeeming Solana assets on a near-monthly basis. Some 4.18 million SOL, worth an estimated $977 million, still remains staked.

Notably, Galaxy Digital has reportedly acquired 2.31 million SOL, valued at nearly $536 million. The tokens were transferred to Galaxy from Binance, Bybit, and Coinbase wallets.

Quick FAQ

- Why did crypto move with stocks today?

The crypto market has increased over the past day, as the stock market recorded some record highs on its previous day of trading. By the closing time on Thursday, the S&P 500 was up by 0.85%, the Nasdaq-100 increased by 0.6%, and the Dow Jones Industrial Average rose 1.36%. Thursday’s US consumer inflation data was as expected, while the Producer Price Index released a day earlier showed that wholesale prices surprisingly dropped in August. The data boosted the stock market, with the expectation of rate cuts next week.

- Is this rally sustainable?

The market is still consolidating, but the current rally may persist in the short term. That said, further pullbacks are likely before the next significant pullback expected by investors, traders, analysts, and industry insiders alike.