The cryptocurrency market is in the green today, with total market capitalization rising 1.6% to $4.19 trillion, according to data at the time of writing. The 24-hour trading volume has reached $211.5 billion, signaling strong investor activity.

TLDR:

- 8 of the top 10 coins are green; ETH and DOGE slipped slightly;

- BTC is up 0.6% to $117,147; ETH is down 0.2% to $4,578;

- BTC faces resistance at $118K; support lies at $115K;

- Fear & Greed Index holds steady at 51 (Neutral);

- BTC ETFs saw $51.28M in outflows; IBIT added $149.73M;

- ETH ETFs saw $1.89M in outflows; BlackRock’s ETHA gained $25.86M;

- Traders now await macro data for the next major move.

Why Is Crypto Up Today: Crypto Winners & Losers

Among the top 10 cryptocurrencies by market cap, eight posted gains over the past 24 hours, while only two, Ethereum and Dogecoin, recorded slight losses.

Bitcoin (BTC) is up 0.6%, now trading at $117,147, with a market cap of over $2.33 trillion.

Ethereum (ETH) is down 0.2% to $4,578, marking a minor dip after recent gains.

XRP (XRP) climbed 3.3% to $3.11, continuing its steady uptrend.

BNB (BNB) posted one of the strongest performances among top assets, up 4.2% to $993.35 in the last 24 hours.

Solana (SOL) gained 4.9%, now priced at $245.80, with a 9.4% rise over the past week.

Dogecoin (DOGE) slipped 0.7% to $0.279, the largest daily drop among top 10 coins.

On the trending side, Aster surged 284.1% to $0.6302, while APX leads the gainers list with a staggering 363.4% increase. Lagrange also climbed 57%, rounding out today’s top-performing coins.

Bitcoin climbed Thursday as traders looked to flip it into a key support level following the US Federal Reserve’s 0.25% rate cut, the first of 2025. The move sparked volatility, with BTC briefly dipping below $115,000 before rebounding, triggering over $100 million in liquidations across both long and short positions.

Market participants are now eyeing the $118,000 resistance zone, with hopes of pushing toward new all-time highs if momentum continues. Analysts like Michaël van de Poppe say a breakout could also trigger major moves across altcoins once Bitcoin stabilizes.

BTC Holds Steady Near $117K Post-Fed Cut

Bitunix analysts noted that the crypto market remained relatively stable following the Federal Reserve’s decision to cut interest rates by 25 basis points, setting the target range at 4.00% to 4.25%.

The move, while widely expected, did not trigger sharp price swings, with Bitcoin trading near $117,000 and Ethereum holding in the mid-$4,500s. Hong Kong’s HKMA mirrored the Fed with its own 25 bp cut, maintaining alignment with the USD peg.

Market attention now turns to upcoming macro data and liquidity flows heading into the weekend, the analysts said, advising traders to manage risk carefully in this range-bound environment. “For BTC, resistance 117k to 118k and support 115k. A sustained 30-min close above 118k can open 120k,” they wrote.

On the downside, a failure to hold $115K may invite a slide toward $114K, per the analysts.

From a tactical view, Bitunix emphasized caution, especially around upper Bollinger Band levels on intraday charts. “Avoid chasing wicks near the upper Bollinger on intraday moves,” they advised.

Levels & Events to Watch Next

As of Thursday morning, Bitcoin’s price has been climbing steadily, with BTC now pushing against the $117,000–$118,000 resistance zone. A strong move above $118,000 could open the door to further upside toward $120,000 and $124,000.

If BTC fails to hold current levels, downside support lies at $115,000, followed by $112,000. Traders are closely watching weekend liquidity flows and post-Fed reaction levels for signs of momentum.

Meanwhile, Ethereumis trading around $4,581, slightly down 0.24% for the day. The price has been hovering within a tight range after hitting highs near $4,800 earlier this month. Currently, ETH needs to reclaim $4,600 to retest the upper levels at $4,700 and potentially challenge the $4,800–$4,880 resistance band.

On the downside, a break below $4,500 could lead to a test of the $4,400 level, with further support seen near $4,250 if weakness extends.

With post-Fed market volatility still playing out, traders are watching closely for confirmed moves beyond these key zones.

Meanwhile, market sentiment has stayed relatively flat in recent days. According to the Crypto Fear and Greed Index, sentiment sits at 51 (Neutral), unchanged from yesterday and up slightly from 47 last week.

While the index shows a slight improvement in mood, investors appear cautious, reflecting a wait-and-see attitude as the market digests macroeconomic cues. Despite Bitcoin nearing resistance levels, the overall sentiment suggests neither strong fear nor excessive greed, signaling a balanced but fragile outlook.

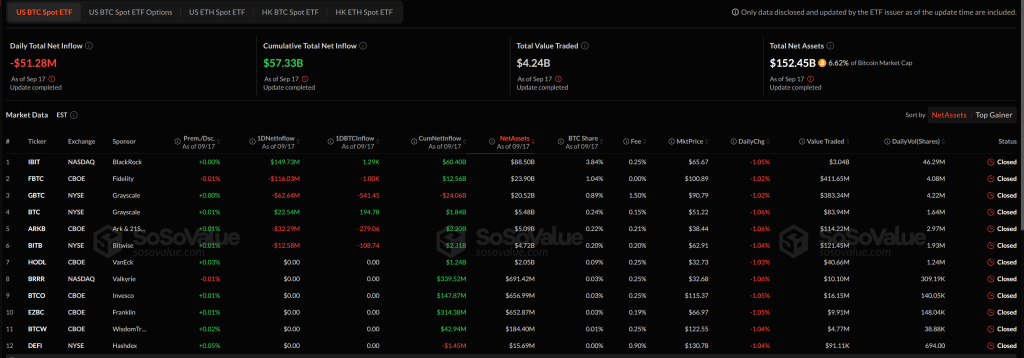

On Wednesday, US spot Bitcoin ETFs posted a net outflow of $51.28 million, ending a streak of inflows and highlighting renewed market caution. Despite the daily setback, the cumulative net inflow remains strong at $57.33 billion, with total net assets across all funds at $152.45 billion, or 6.62% of Bitcoin’s market cap.

Among the 12 ETFs listed, BlackRock’s iShares Bitcoin Trust (IBIT) stood out, attracting $149.73 million in net inflows—making it the day’s top performer by a wide margin. Meanwhile, Fidelity’s FBTC and Grayscale’s GBTC experienced notable outflows of $116.03 million and $62.64 million, respectively.

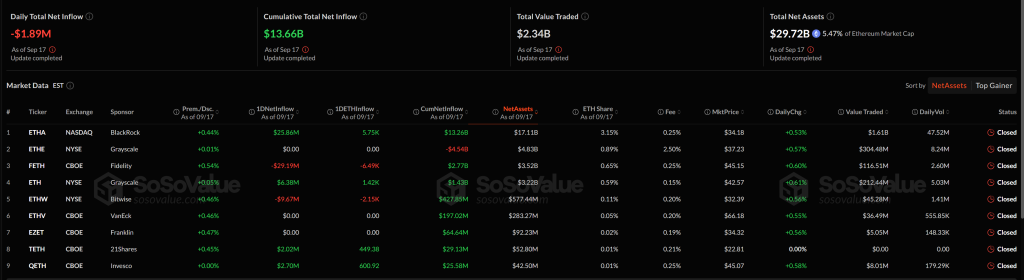

Similarly, US spot Ethereum ETFs recorded a net outflow of $1.89 million, breaking their multi-day inflow streak. The cumulative net inflow across ETH funds remains at $13.66 billion, with $29.72 billion in total net assets, representing 5.47% of Ethereum’s market cap.

Among the nine listed ETFs, BlackRock’s ETHA led the day with $25.86 million in inflows, while Grayscale’s ETH added $6.38 million. On the other hand, Fidelity’s FETH saw the sharpest outflow at $29.19 million, followed by Bitwise’s ETHW, which lost $9.67 million.

Quick FAQ

1. Why did crypto move against stocks today?

The crypto market has increased over the past day, while the stock market decreased on its previous day of trading, rising to record highs. By the closing time on Wednesday, the S&P 500 was down by 0.097%, the Nasdaq-100 declined by 0.21%, and the Dow Jones Industrial Average rose 0.57%.

2. Is this surge sustainable?

The market remains in a consolidation phase, and the recent uptick may face resistance in the near term. While sentiment has improved, many analysts suggest that the bullish momentum depends on upcoming macro data, as much of the optimism around the rate cut may already be priced in.