The Bitcoin price may look muted, but underneath the surface, speculative pressure is building rapidly. Trading at $105,100 with over $47 billion in 24-hour volume, Bitcoin is still the king of the crypto market. Down 0.23% today, traders are divided, will BTC hit six figures soon or pull back?

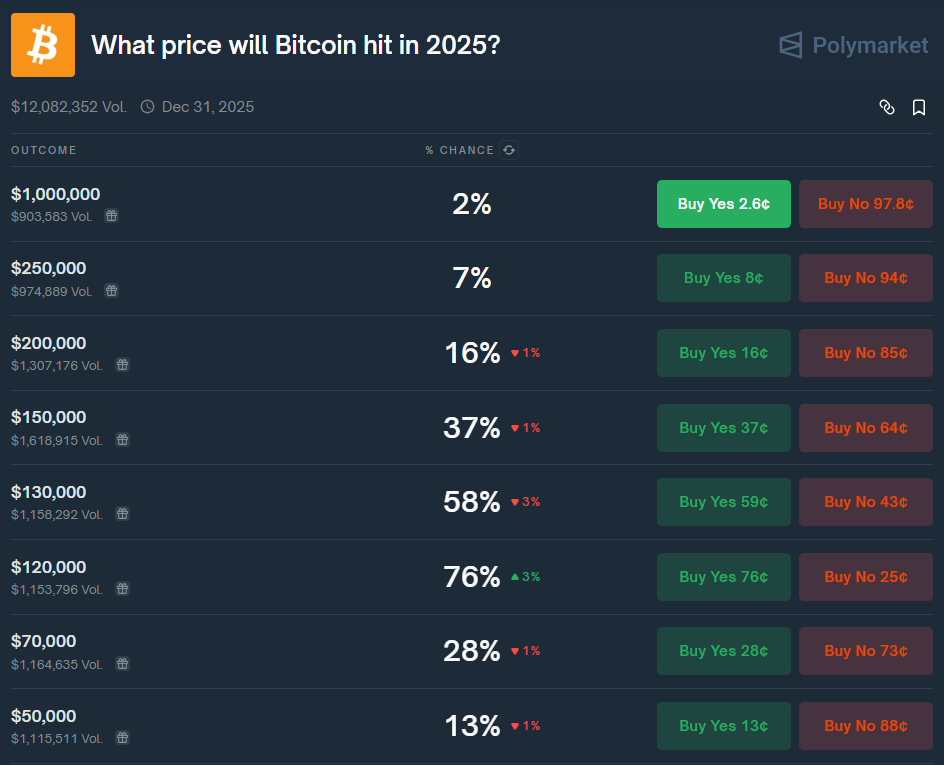

Polymarket, the prediction platform, shows traders are very bullish. The most popular bet right now? Bitcoin is expected to reach $120,000 by year-end. With over $1.15 million in volume behind it, the market currently gives this target a 76% probability, up 3% from earlier this month.

Other high-stakes predictions:

- $130,000: 58% odds | $1.15M volume

- $150,000: 37% odds | $1.62M volume

- $200,000: 16% odds | $1.31M volume

- $250,000: 7% odds | $974K volume

- $1 million: 2% odds | $903K volume

Meanwhile, bearish bets are significantly smaller:

- $70,000: 28% odds | $1.16M volume

- $50,000: 13% odds | $1.11M volume

There’s almost no money to be made on a return to $20,000, with volume too small to be listed. While investors remain bullish, expectations are more tempered than the six-figure moonshot forecasts often cited by hardcore Bitcoin maximalists.

Triangle Squeeze: What Bitcoin Charts Say

The long-term outlook is bullish, while the short-term outlook is a breakout near, but not necessarily upward. Bitcoin is currently inside a symmetrical triangle on the 2-hour chart, indicating that volatility is about to return.

Here’s what to note:

- BTC is hugging the lower triangle boundary at $105,000

- 50-EMA at $105,420 is resistance

- MACD is bearish with a negative crossover and red histogram

- June 3 was a shooting star at $106,767, rejection

Bitcoin Trade Outlook

- Bearish: Break below $105,000 could go to $104,098, then $102,111

- Bullish: Bounce from support could retest $106,767 and then $107,811

Wait for a confirmed breakout before acting.

Will Bitcoin Break or Bounce?

Fundamentals and sentiment are one way, and short-term technicals are the other. Bitcoin is at a crossroads. The symmetrical triangle is a compressed market structure that typically leads to significant price movements. The question is—up or down?

For now, the broader market is still bullish:

- Ethereum above $2,618

- Altcoins like Solana (+4.2%), Dogecoin (+2.1%), XRP (+2.9%) are up

- Bitcoin dominance is steady, waiting, and seeing

But all eyes are on $105K. If Bitcoin holds, $120K by year-end isn’t far off. If it breaks, bulls need to adjust fast.

BTC Bull Token Presale Nears $7.78M Cap as 61% APY Staking Draws Yield Hunters

With Bitcoin trading near $105K, investor focus is shifting toward altcoins, especially BTC Bull Token ($BTCBULL). The project has now raised $6,801,303 out of its $7,789,647 cap, leaving less than $1 million before the next token price hike. The current price of $0.002545 is expected to rise once the cap is met.

BTC Bull Token links its value directly to Bitcoin through two core mechanisms:

- BTC Airdrops reward holders, with presale participants receiving priority.

- Supply Burns occur automatically every time BTC increases by $50,000, reducing $BTCBULL’s circulating supply.

The token also features a 61% APY staking pool holding over 1.73 billion tokens, offering:

- No lockups or fees

- Full liquidity

- Stable passive yields, even in volatile markets

This staking model appeals to both DeFi veterans and newcomers seeking hands-off income.

With just hours left and the hard cap nearly reached, momentum is building fast. BTCBULL’s blend of Bitcoin-linked value, scarcity mechanics, and flexible staking is fueling strong demand. Early buyers have a limited time to enter before the next pricing tier activates.