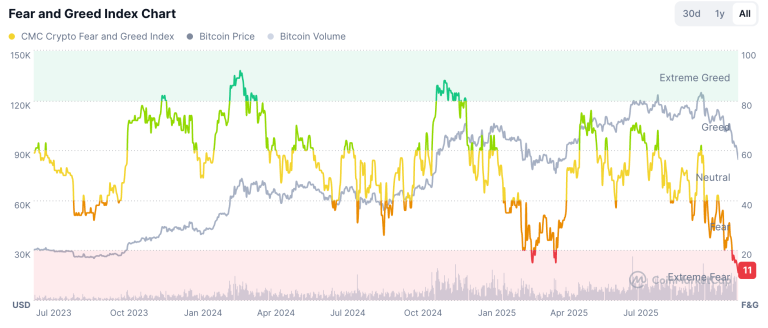

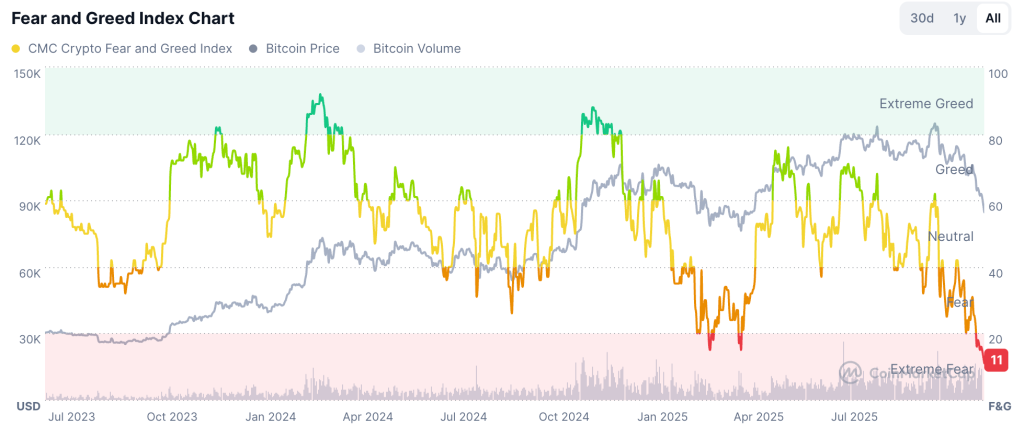

Fear is dominating today’s trading across the crypto market as the CMC Crypto Fear and Greed Index sits at 11, the lowest reading since its launch, while Bitcoin is trading around $83,000 after retreating sharply from recent six-figure levels.

Market data and recent commentary attribute the slide to heavy liquidations, fading inflows into spot products, and renewed concerns about global growth and policy uncertainty, all of which have pushed positioning toward cash and reduced exposure to higher-risk assets.

This shift is visible across the entire market rather than in isolated pockets. In this environment, price weakness across major tokens reflects the broadest caution rather than project-specific failures, reinforcing the sense that crypto season remains in a defensive phase.

Crypto Fear and Greed Index (Source: CoinMarketCap)

Bitcoin Sets the Tone Under Record Fear

Bitcoin is now trading near $83,880, down by about 7.5% over the past 24 hours, after briefly testing levels near $80,000. Derivatives activity shows rising long liquidations and negative funding, pointing to a rapid reduction of leveraged positioning.

The move should be viewed as an extension of a wider reset from October’s highs, with participants locking in gains and reducing exposure under tightening financial conditions.

The drop in sentiment indicators conveys more than price alone. A fear reading at these levels suggests that risk tolerance has narrowed sharply, which often results in slower rotation, fewer speculative trades, and a greater focus on capital preservation.

In such phases, Bitcoin’s direction tends to dominate flows across the market, leaving secondary tokens little room to diverge meaningfully.

Large Caps Follow the Broader Retreat

Altcoins have tracked the same downward path. BNB is trading near $821, Solana around $126, and Cardano close to $0.404, each posting sharp declines of up to 12% within the past 24 hours.

While liquidity on major venues remains workable, flows skew toward sellers and systematic reduction of exposure, indicating that the pressure stems more from macro and sentiment forces than from token-level developments.

Rather than showing new weakness specific to these networks, the declines reflect how even established ecosystems struggle when fear takes hold.

In conditions where Bitcoin loses ground and confidence fades, large caps often move in tandem, shaped by a market-wide desire to reduce risk rather than by changes in their underlying structures or activity.

What Is Driving the Extreme Fear in Altcoin Season

Several factors converge behind this altcoin season of depression. Bitcoin’s reversal from recent peaks has unsettled momentum-driven positioning. Outflows from some spot products reduce a key source of incremental demand.

At the same time, global tensions, economic concerns, and shifting expectations regarding interest rates continue to weigh on risk assets more broadly, including crypto.

These elements create an atmosphere where caution dominates decision-making. Participants typically trim exposure to complex positions, unwind leverage, and concentrate liquidity into stable instruments until clearer signs of stability emerge. That pattern explains why the altcoin season remains distant, even as occasional, short-lived rebounds appear.

The current drawdown points to a market focused on preservation rather than expansion. With sentiment at historic lows, new capital tends to wait for clearer confirmation before reengaging. Recovery phases typically rely on stabilization in Bitcoin, renewed confidence in macroeconomic conditions, and a gradual return of volume that indicates a willingness to reassess risk.

For now, the heavy retreat across Bitcoin, BNB, Solana, Cardano, and almost all major coins illustrates how deeply sentiment controls the cycle. Crypto season in its typical form, marked by broad participation and rising secondary assets, remains on pause until fear subsides and conditions show sustained balance between supply and demand.