XRP is attempting to stabilise after a sharp sell-off pushed the token to its lowest levels since April, underscoring the fragility of sentiment across the altcoin market. While prices have rebounded toward $1.94, the recovery is still tentative, with investors weighing improving long-term fundamentals against a technically fragile structure.

With XRP ranked fourth by market capitalisation at roughly $118 bn and daily turnover near $2.9 bn, liquidity remains deep.

But recent price action shows that even large-cap tokens are struggling to escape the gravitational pull of tightening global liquidity and Bitcoin’s market dominance.

Altcoin Pressure Shapes the Macro Backdrop

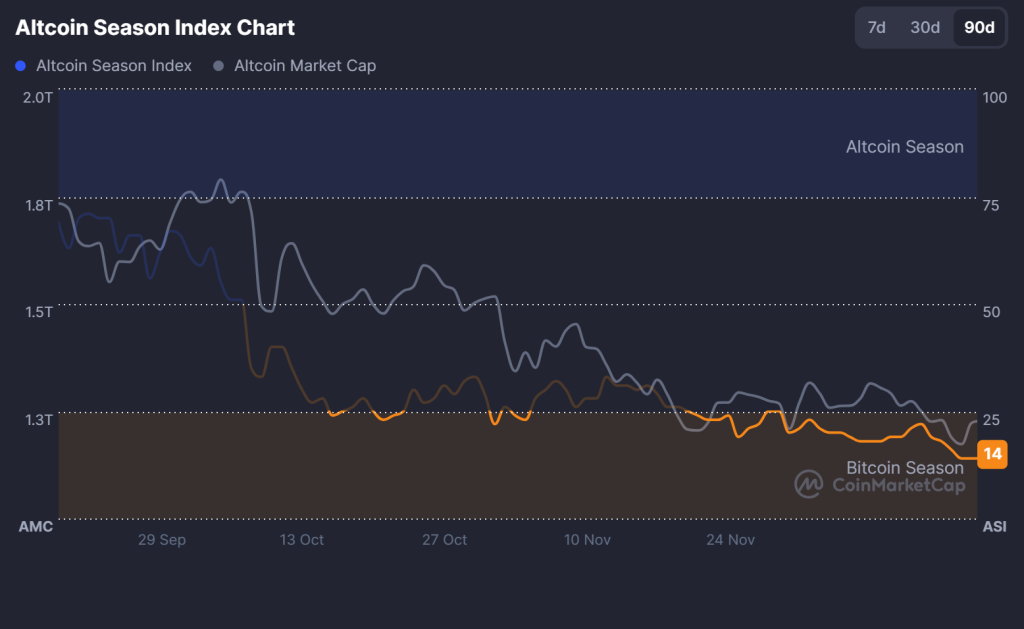

XRP’s decline unfolded amid a broader rotation away from higher-beta crypto assets. Ethereum, Solana, and Cardano have all posted steeper weekly losses, while the Altcoin Season Index remains deeply suppressed at 14. That backdrop reflects cautious positioning rather than outright capitulation.

Macro signals have also played a role. Ahead of the Bank of Japan’s rate decision, traders reduced exposure across risk assets. Although the BoJ’s expected hike briefly eased pressure, it did little to shift the broader risk narrative, leaving XRP sensitive to funding conditions and sentiment swings.

Fundamentals Still Support the Long View

Despite near-term volatility, XRP’s structural story remains intact. Its role in cross-border payments, its efforts to improve regulatory clarity in key jurisdictions, and its consistently high on-chain liquidity continue to attract institutional interest.

Volume spikes during the recent sell-off suggest repositioning rather than wholesale abandonment.

- Market capitalisation near $118 bn keeps XRP among the most liquid digital assets

- Circulating supply sits just above 60.5 bn tokens, with issuance well understood

- Rising volume during rebounds points to active dip participation

XRP Price Prediction: Downtrend Tested as Buyers Probe a Critical Pivot

From a chart perspective, XRP price prediction seems bearish. XRP is trading within a descending channel that has capped rallies since early December. The rebound from $1.85 was technically constructive, with bullish candles and RSI recovering toward 58, signalling easing downside momentum.

However, price remains boxed in:

- Resistance: $1.98–$2.00, followed by $2.05 and $2.17

- Support: $1.85, then $1.77 if selling pressure resumes

A sustained break above $2.00 would confirm a trend shift and open the door toward $2.17. Failure at resistance keeps the risk skewed toward a retest of lower supports.

From Stabilisation to Setup

For now, XRP sits at a crossroads. The next few sessions will determine whether the current rebound evolves into a trend reversal or fades into another lower high. That makes the coming technical resolution critical for shaping the next leg of XRP’s price path.

Trade idea: Acceptance above $2.00 targets $2.11–$2.17; rejection keeps downside risk toward $1.85 and $1.77.

PEPENODE: A Mine-to-Earn Meme Coin Nearing Presale Close

PEPENODE is gaining momentum as a next-generation meme coin that blends viral culture with interactive gameplay. With over $2.37 mn raised and the presale approaching its cap, interest is building fast as the countdown enters its final stretch.

What makes PEPENODE stand out is its mine-to-earn virtual ecosystem. Instead of passive holding, users can build digital server rooms using Miner Nodes and facilities, earning simulated rewards through a visual dashboard. The concept brings gamification and competition into the meme coin space, giving holders something to do before launch.

The project also offers presale staking, allowing early participants to earn boosted rewards ahead of the token generation event. Leaderboards and bonus incentives are planned post-launch to keep engagement high.

With 1 $PEPENODE priced at $0.0012016 and limited allocation remaining, the presale is entering its final opportunity window for early buyers.

Click Here to Participate in the Presale