XRP is trading around $2.0725, stabilizing after dipping to an intraday low of $2.02. Despite short‑term weakness, Ripple’s token is showing resilience at the $2.0702 support zone, where buyers have stepped in to defend key levels.

This stabilization comes as traders weigh both technical signals and broader sentiment across the crypto market.

Golden Cross Sparks Bullish Momentum

XRP formed its first golden cross of 2026, a bullish technical event where the 23‑day moving average crossed above the 50‑day moving average. Historically, this pattern signals a shift toward upward momentum.

As long as XRP holds above the $2.02–$2.03 support band, the bullish setup remains intact. Traders are now watching the $2.28–$2.35 resistance zone, where the 200‑day EMA sits as a major hurdle.

- Current price: $2.0725

- Key support: $2.02–$2.07

- Resistance levels: $2.28–$2.35, $2.70

- RSI: 47.92, showing early bullish divergence

XRP Price Forecast: Support Holds at $2.07 as Triangle Pattern Signals Breakout

The 4‑hour chart reveals a descending triangle pattern, typically bearish, but recent price action suggests a potential bullish divergence.

RSI has crossed above its moving average, hinting at building momentum. A bullish engulfing candle near $2.0415 adds weight to the case for upside.

If XRP breaks above $2.1126 with volume confirmation, targets include $2.1837 and $2.2721, with a move beyond $2.2726 opening the door to a retest of the $2.30–$2.35 range.

XRP/USD Price Outlook for Traders

Despite volatility, XRP’s golden cross and triangle setup provide a clear roadmap. A daily close above $2.10 could accelerate gains toward $2.35, while holding above support strengthens the case for a rally toward $2.70.

With crypto sentiment stabilizing, XRP offers a compelling opportunity for traders and presale participants seeking momentum in early 2026.

XRP price prediction is likely to be bullish if it breaks above $2.1126 with volume confirmation, it could target the 0.382 retracement at $2.1837, followed by the 0.236 level at $2.2721. A move beyond $2.2726 would invalidate the triangle’s bearish bias and open the door to a retest of the $2.30–$2.35 range.

Traders should watch for a clean breakout above the triangle’s upper trendline and monitor RSI for continued divergence. With broader crypto sentiment stabilizing and XRP showing technical resilience, this setup could offer a compelling entry for presale participants looking to ride momentum toward higher levels in Q1 2026.

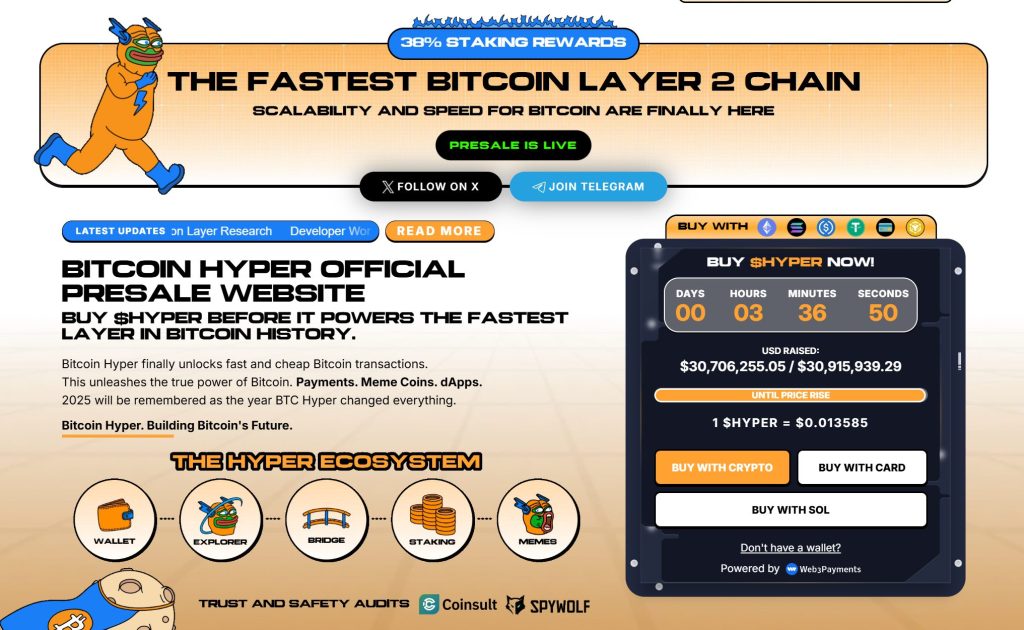

Bitcoin Hyper: The Next Evolution of BTC on Solana?

Bitcoin Hyper ($HYPER) is bringing a new phase to the Bitcoin ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $30.7 million, with tokens priced at just $0.013585 before the next increase.

As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems. If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the Presale