XRP’s 90-day moving average whale flow has shifted dramatically into negative territory, indicating renewed distribution activity among major holders, a development that typically precedes bearish price movements.

Data from CryptoQuant reveals a similar distribution pattern emerged during January and February, when XRP peaked near $3.45 before experiencing substantial whale selling pressure.

This activity ultimately drove prices down to $1.77 by late February, representing a significant correction.

XRP Whale Flows Echo January’s -48% Bearish Crash Pattern

XRP is currently trading around $2.99 following its July peak of $3.66, touching a low of $2.72 in early August, and appears structurally vulnerable to further declines.

CryptoQuant analyst “The Enigma Trader” emphasized that without sustained positive whale flows exceeding 5 million XRP daily, the market structure remains fundamentally weak.

Presently, large holders show no consistent accumulation patterns, a crucial element needed for any meaningful trend reversal.

XRP now faces a pivotal moment that will determine whether bearish forces gain control or if bulls can successfully defend the critical $2.80 support level.

Signs of bull exhaustion are becoming apparent, with XRP spot trading volume dropping 28% over the past 24 hours despite a 2.42% price increase.

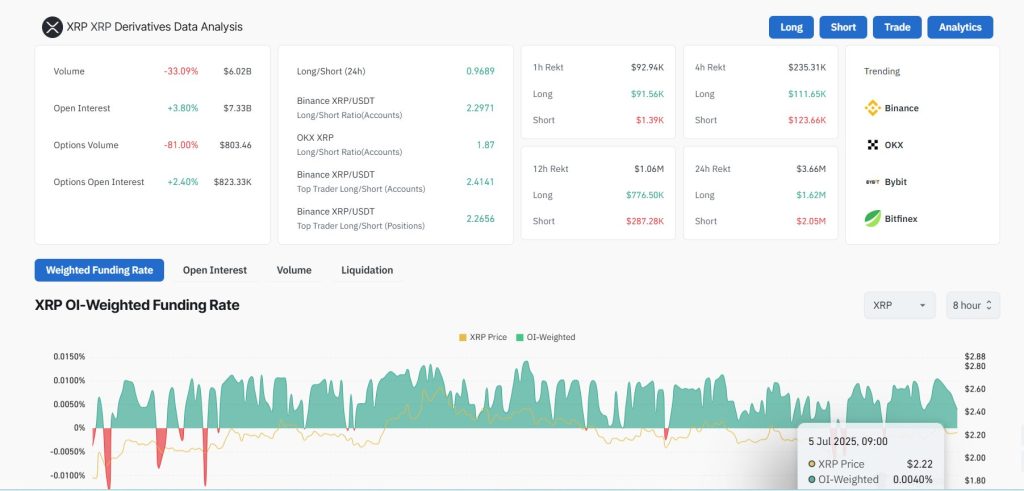

Futures market data from Coinglass paints an equally concerning picture, showing derivative volume declining by 33.09% while short positions increased by 3.80%.

Open interest among traders betting against XRP has risen substantially, with over $7.3 billion in trading activity.

The bearish sentiment intensified following Ripple co-founder Chris Larsen’s recent $175 million XRP sale, creating additional headwinds for the asset’s attempt to breach the $3.20 resistance zone.

Nevertheless, XRP has weathered more severe bearish cycles previously, and recent institutional developments provide reason for optimism.

XRP Technical Analysis: Double-Top at $3.60 Threatens Bulls

Technical analysis of the 4-hour XRP/USDT chart reveals a distinct double-top pattern forming around the $3.60 resistance zone.

This level has twice rejected bullish advances, establishing itself as a formidable barrier to upward momentum.

Following failed attempts to breach this resistance, price action retreated to find support near $2.70, the launch point of July’s rally.

This zone now functions as a critical support foundation, with recent trading activity showing a sequence of higher lows developing from this base, indicating bulls are actively defending the level.

The Relative Strength Index currently sits at approximately 51, reflecting neutral market conditions with neither overbought nor oversold readings. This positioning allows for potential movement in either direction.

However, the recovery from $2.70, combined with the emerging pattern of higher lows, suggests building bullish pressure beneath current levels.

Should XRP maintain its position above the $2.90-$3.00 range, the probability increases for another test of the double-top resistance at $3.60.

A clear break and sustained close above this level could catalyze significant bullish continuation, whereas rejection at this resistance may trigger another retest of the $2.70 support zone.