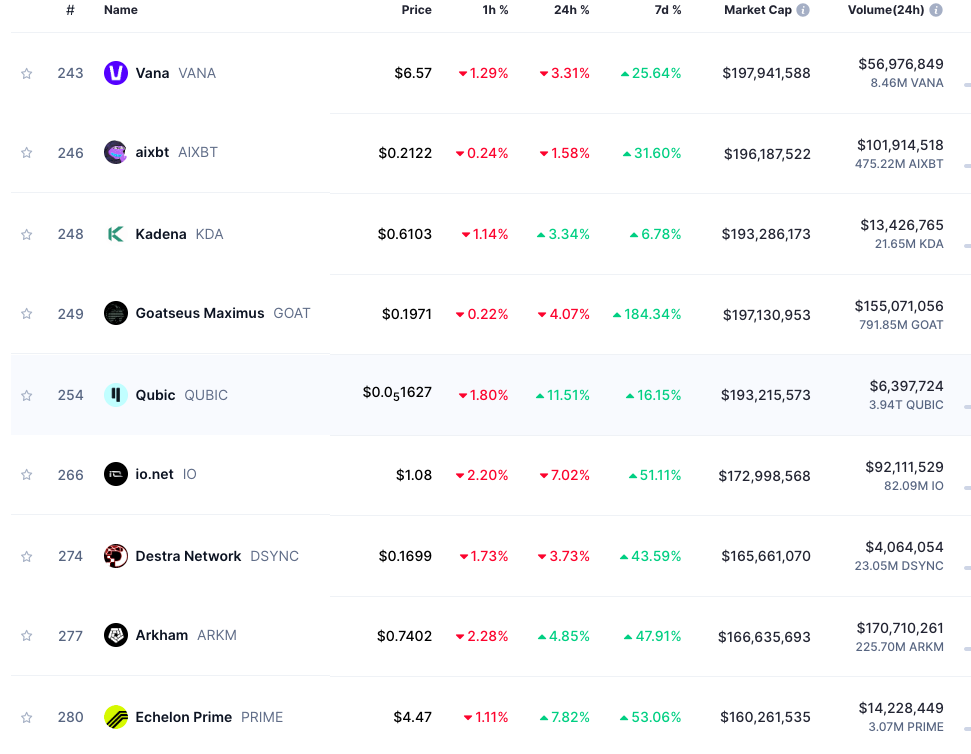

Blockchain analytics platform Arkham ($ARKM) has recorded a 6.5% uptick in the past 24 hours, pushing its monthly gains to 50.62%. Last month, $ARKM was trading at $0.4685.

As of press time, it stands at $0.7567, after reaching a daily high of $0.8382. Traders anticipate the token could revisit its 2024 high of $3.99 as market sentiment remains bullish.

Arkham’s Growth Trajectory: Still Undervalued vs. Competitors?

Despite the rally, Arkham’s market cap of $190 million trails behind key rivals in AI and blockchain analytics. For instance, AI agent AIXBT, which operates via X (formerly Twitter) to provide sentiment analysis, is valued at over $190 million.

Another data infrastructure project, Kaito, focused on social data analytics, holds a valuation exceeding $400 million. Yet Arkham’s unique positioning, including real-time transaction tracking, wallet identification, and its new U.S.-based Arkham Exchange (combining analytics with trading), could fuel a rebound.

Recently, it expanded its services to include spot and futures trading on its newly launched Arkham Exchange in the U.S., integrating its analytics platform with direct trading access.

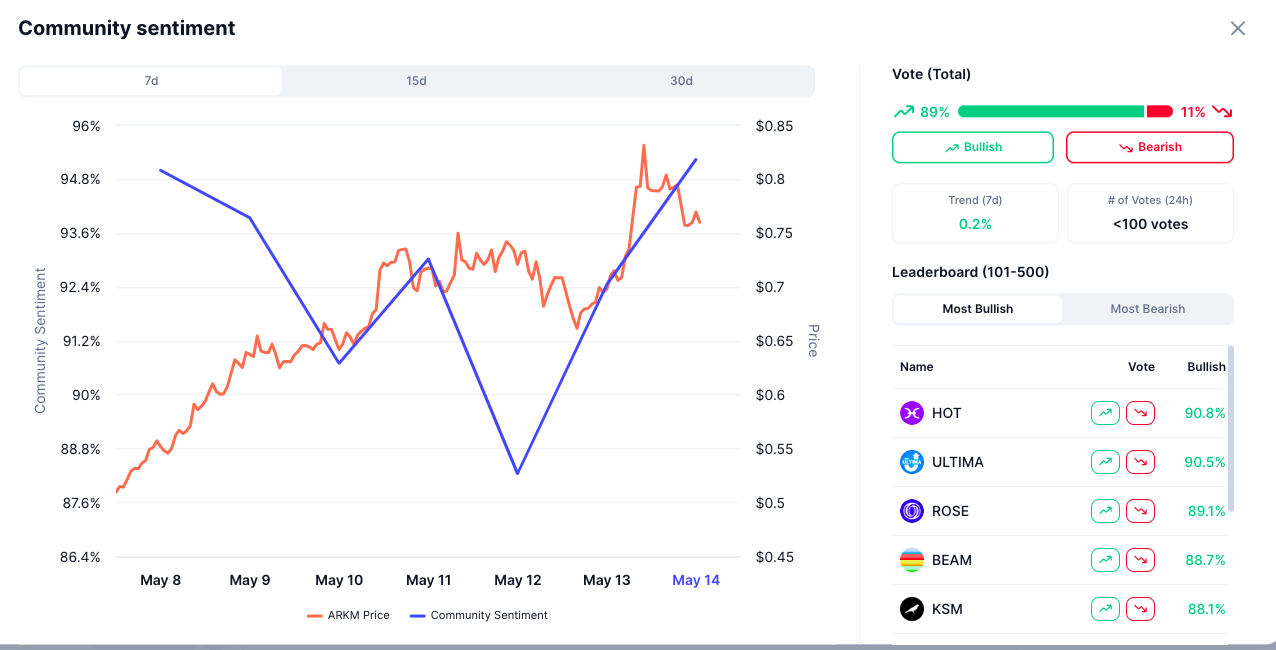

According to CoinMarketCap community sentiment, over 89% of 33,000 voters anticipate further price growth, with many eyeing the $0.85 level as a short-term target.

A new feature could be fueling this optimism. Arkham now lets users track wallets tied to major X accounts with over 100,000 followers.

This includes high-profile figures like Ethereum’s Vitalik Buterin, Tron’s Justin Sun, and even U.S. President Donald Trump, giving traders insights into the moves of influential market players.

How Arkham Helped Crack the $1.5B Bybit Hack

Arkham’s reputation for blockchain transparency has been bolstered by its role in key investigations.

During the infamous $1.5 billion Bybit hack, Arkham partnered with blockchain sleuth ZachXBT to trace the stolen funds, awarding him a 50,000 $ARKM token bounty for successfully identifying the hacker using Arkham’s analytics.

Listed on Binance since 2023, $ARKM is described as an “intel-to-earn” token, a tool that fuels blockchain transparency through AI.

Technical Indicators Present a 136% Upside for $ARKM

After bottoming out at around $0.35, $ARKM has formed a broad ascending base. The price has now surged past $0.70, reaching $0.737 at the time of the snapshot.

The volume on the breakout exceeded 16.3M, indicating strong buying interest and potential accumulation.

The RSI Divergence Indicator (14, close) shows a clear bullish divergence from February through April, with several “Bull” indicators confirmed.

RSI is now at 66.07, just under overbought territory, suggesting momentum is still strong but nearing a possible cooling-off zone.

Looking ahead, the chart identifies three key price targets. The first lies at $1.043, marking the initial area of resistance where some traders may look to take profits or where the price might consolidate.

If this level is surpassed, the next target is set at $1.351, a zone that previously acted as support and may now present resistance.

The final target is projected at $1.795, representing a full move from the breakout zone and a potential gain of 136.12%

Key support remains around $0.60–$0.65, where the breakout occurred. This area should be watched closely for confirmation of support if a retest occurs.