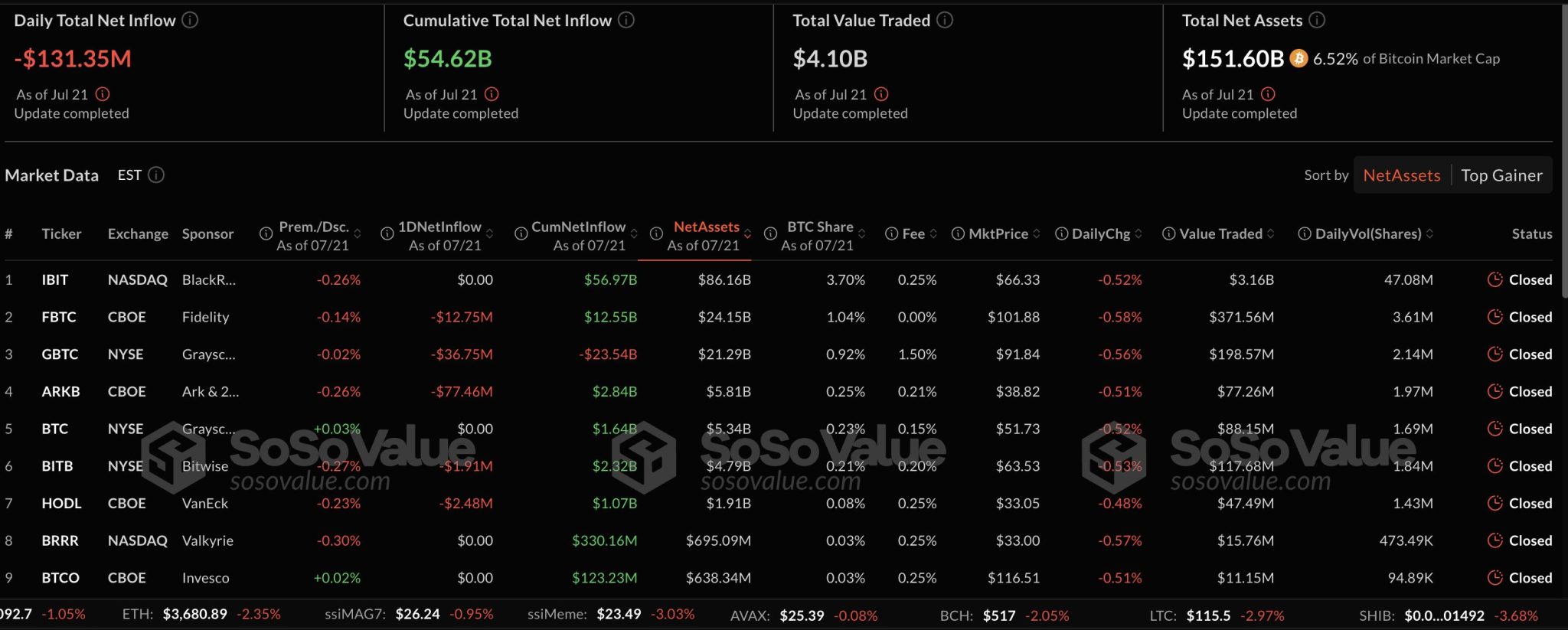

Bitcoin spot exchange-traded funds (ETFs) recorded a net outflow of $131.35m on July 21, ending a 12-day run of continuous inflows, according to data from SoSoValue.

The reversal follows shifting investor sentiment and portfolio rebalancing, while Ethereum spot ETFs logged strong gains, pulling in nearly $297m the same day.

The outflow marked a pause in what had been a robust period for Bitcoin funds, which had collectively attracted over $6.6b in net inflows since early July.

This sudden shift may reflect profit-taking following Bitcoin’s stabilization in the $98,000 to $117,000 range after recent highs. Institutional investors, particularly those nearing quarter-end rebalancing cycles, could also be moving capital into alternative assets or reducing crypto exposure.

Top Bitcoin ETFs See Mixed Flows Despite Strong Trading Volumes

Leading Bitcoin ETFs, including BlackRock’s IBIT and Fidelity’s FBTC, posted flat or negative net inflows. IBIT reported zero net inflow despite holding the largest net asset value among peers at $86.16b. Ark Invest’s ARKB and Grayscale’s GBTC recorded notable outflows of $77.46m and $36.75m, respectively.

Overall, total net assets across all US Bitcoin spot ETFs now stand at $151.6b, accounting for 6.52% of Bitcoin’s total market capitalization. Trading activity also remained strong, with $4.1b in daily volume on July 21, despite the outflow trend.

Ethereum ETFs Extend Inflow Streak, Pulling in Nearly $300M in a Day

In contrast, Ethereum spot ETFs continued their upward momentum. For the twelfth straight day, ETH-based funds attracted net inflows, totaling $296.59m. BlackRock’s ETHA led the pack with $101.98m in new capital, bringing its cumulative inflow to over $8.16b. Fidelity’s FETH followed with $126.93m in daily inflow and a total net asset value of $2.08b.

Grayscale’s twin Ethereum funds, ETHE and ETH, posted mixed results, with one recording a modest net outflow while the other gained $54.90m. Other players such as VanEck and Franklin Templeton also contributed to the day’s inflow momentum.

Ethereum ETFs now manage a combined $19.6b in net assets, equivalent to 4.32% of Ethereum’s total market cap. Daily trading volumes reached $3.21b across the ETH ETF market.

Analysts See Market Rebalancing as Ethereum Outpaces Bitcoin in Flows

Analysts suggest the contrasting flows highlight diverging investor expectations. Bitcoin’s rally may be losing steam in the near term, while Ethereum is gaining traction after the GENIUS and CLARITY Acts proceed to the final vote. These proposed laws could pave the way for greater integration of Ethereum-based assets in traditional finance.

Another factor drawing attention is the inclusion of staked Ether in ETF offerings. These structures allow investors to gain not just price exposure but also yield, making Ethereum products increasingly attractive to institutional portfolios.

While Bitcoin’s dip may be temporary, the split in ETF flows shows a broader rebalancing underway in the digital asset space, where Ethereum’s evolving narrative continues to gain momentum.