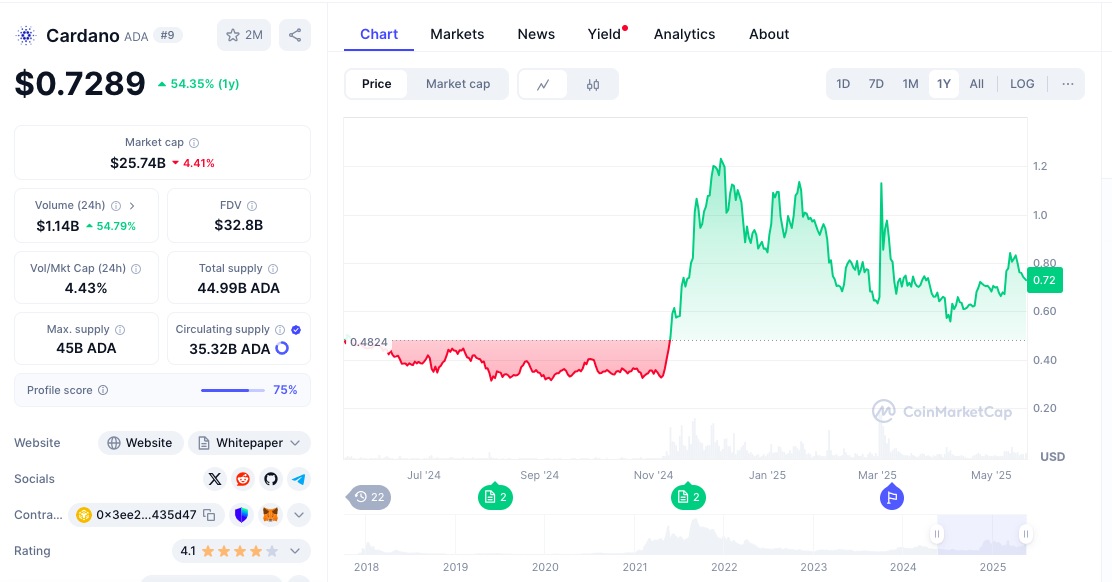

Cardano’s 25% rally vanished in barely 10 days, and on Monday, the token was teetering at $0.72—one misstep could send it tumbling toward levels not seen since before last year’s rebound.

If buyers can’t defend this support, Cardano ($ADA) risks falling further. The native token of the proof-of-stake blockchain has struggled to breach the $1.20 level for nearly three years, having last reached an all-time high of $3.10 in the summer of 2021.

$ADA Struggling at $1: Why Cardano Hasn’t Reclaimed Its Former Glory

Since its launch in September 2017 by Ethereum co-founder Charles Hoskinson, Cardano has maintained a strong position among the top 10 cryptocurrencies.

It currently boasts a market capitalization exceeding $25 billion.

However, $ADA’s inability to reclaim the $1.00 threshold, an area of psychological and technical importance for bulls, has raised concerns among traders about a potential slide into bearish territory.

Despite this, popular crypto analyst Ali Martinez remains optimistic. He suggests that $ADA holding above the $0.72 level could trigger a rebound toward $0.92 in the near term.

Another analysis by Bull Spot Bear points to $ADA’s lagging performance relative to the M2 Global Liquidity Index (global money supply), implying that the token could surge by more than 50% to around $1.80 if it aligns with macro liquidity trends.

On-Chain Indicators Flash Green as Whales Accumulate Millions in $ADA

On-chain data from Santiment further supports this bullish narrative.

Recent whale activity shows that over 80 million $ADA were accumulated in a short span, following a previous 400 million ADA acquisition just two weeks prior.

This accumulation by large holders suggests growing institutional or whale-level confidence.

Trading volume has also seen an uptick. Despite $ADA’s 3.79% price drop in the past 24 hours, trading volume surged by over 54%, with more than $1.14 billion worth of $ADA changing hands, an encouraging sign of continued market engagement.

Futures market sentiment appears similarly bullish.

Derivatives data from Coinglass shows positive funding rates for $ADA/$USDT, $ADA/$USDC, and $ADA/$USD trading pairs across major platforms such as Bybit, OKX, and Binance.

A positive funding rate indicates that long traders are paying shorts, suggesting expectations of price increases.

What’s Next for $ADA? Key Resistance and Support Levels to Watch

$ADA is currently trading within a clearly defined ascending channel on the daily timeframe.

After a strong rally that saw $ADA approach the $0.90 region, the token has entered a corrective phase, now pulling back to the lower boundary of the channel around $0.72.

This level coincides with dynamic trendline support, suggesting a potential rebound zone. The 16.22% upside projection from current levels targets the $0.85–$0.87 area, which sits just beneath a major resistance band spanning from $0.88 to $0.90.

A successful breakout above that range would open the door to retest the higher resistance zone between $1.095 and $1.1499, which was last visited in March and remains a psychologically major level for bulls.

The price structure also shows prior consolidation in the $0.58 to $0.66 range (highlighted in blue), which now acts as a solid demand zone should the channel support fail.

If bulls can defend the lower channel and reclaim short-term momentum, $ADA could begin a fresh leg up, targeting $0.85 first and potentially $1.10.

However, a confirmed breakdown below $0.70 would invalidate this bullish setup and may drag the price back into the previous consolidation zone.