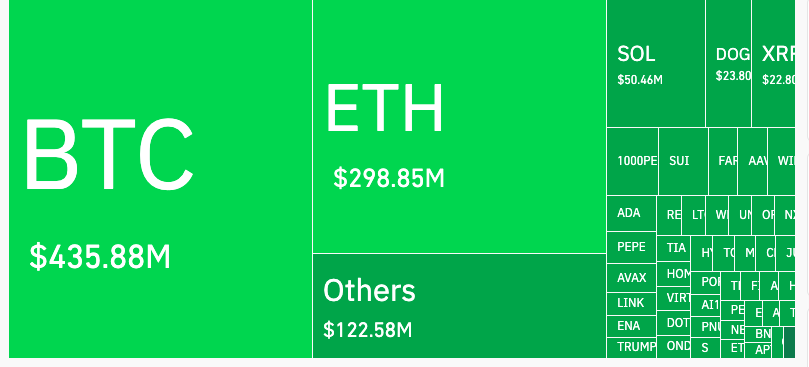

Ethereum ($ETH) plunged 9% Friday morning, wiping out $298 million from 80,000 traders. While panic selling dominated, smart money was buying the dip under $2,500. The crypto followed the market-wide crash, nosediving from $2,771 to $2,443 before finding footing near $2,509.

Trade war fears triggered the sell-off, but savvy investors viewed this as a discount window.

$35.22B Open Interest Explosion: BlackRock and Fresh Money Flood $ETH During Crash

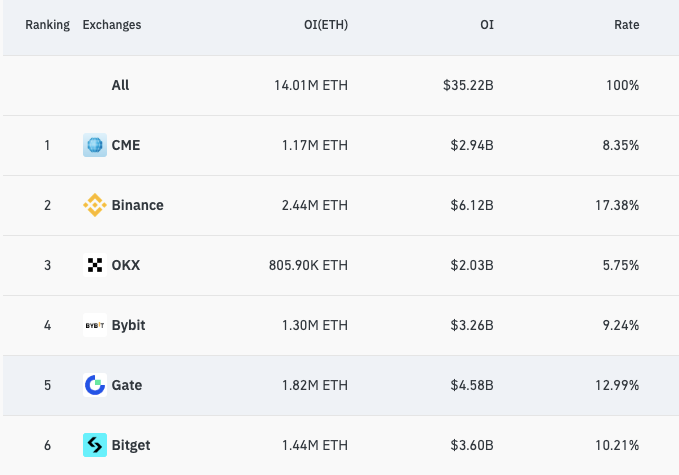

Despite the sell-off, open interest (OI) in Ethereum has increased to $35.22 billion over the past 24 hours.

Major exchanges, including Chicago Mercantile Exchange (CME), Binance, Gate, and Bitget, are witnessing the highest activity, averaging $4 billion worth of $ETH exposure each.

Fresh capital is flowing into the market as open interest rises. This suggests that the trend could continue. More traders are opening or growing their positions.

An Ethereum whale has just placed a substantial bet, taking a $16.6 million long position. This major move demonstrates strong bullish confidence in the altcoin, despite market fluctuations.

Institutional investors continue to buy Ethereum aggressively during the slump. They’re not backing down.

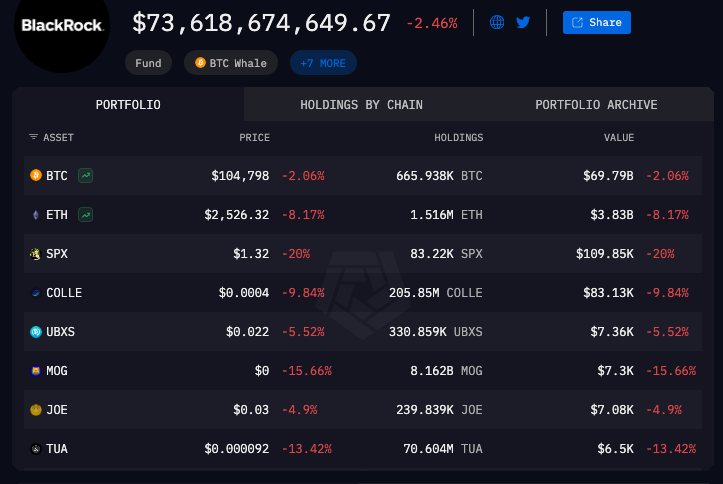

BlackRock, the world’s leading asset management firm with over $73 billion in cryptocurrency holdings, has maintained daily Ethereum purchases for over two weeks.

Over the past 14 days, the traditional finance giant has accumulated a total of $570 million in ETH.

According to data tracked by Arkham Intelligence, BlackRock now controls over 1.5 million $ETH, valued at $3.83 billion at current market prices.

In a parallel move, SharpLink Gaming recently acquired 176,271 $ETH for $463 million, establishing itself as the largest publicly traded holder of Ethereum.

Historic 29-Day Ethereum ETF Streak Breaks Records as DeFi Adoption Surges

Ethereum spot ETFs have recorded positive inflows for 29 consecutive days, marking the first time such a sustained streak has occurred since their launch.

With the SEC adopting a more favorable stance toward DeFi protocols and Ethereum serving as the primary infrastructure for decentralized finance applications, institutional adoption continues to accelerate.

Ethereum’s supply on exchanges has dropped to its lowest level in eight years. This shortage could drive prices higher rapidly. Many crypto investors believe these factors set ETH up to break $4,000 by late 2025.

CLS Global, a major market maker, is even more bullish. They’re eyeing $5,400 for Ethereum in the near term.

Their long-term projection anticipates $7,000 by 2027, representing a substantial upside from current levels.

$2,500 Test: Make-or-Break Level Decides $ETH’s Next Move

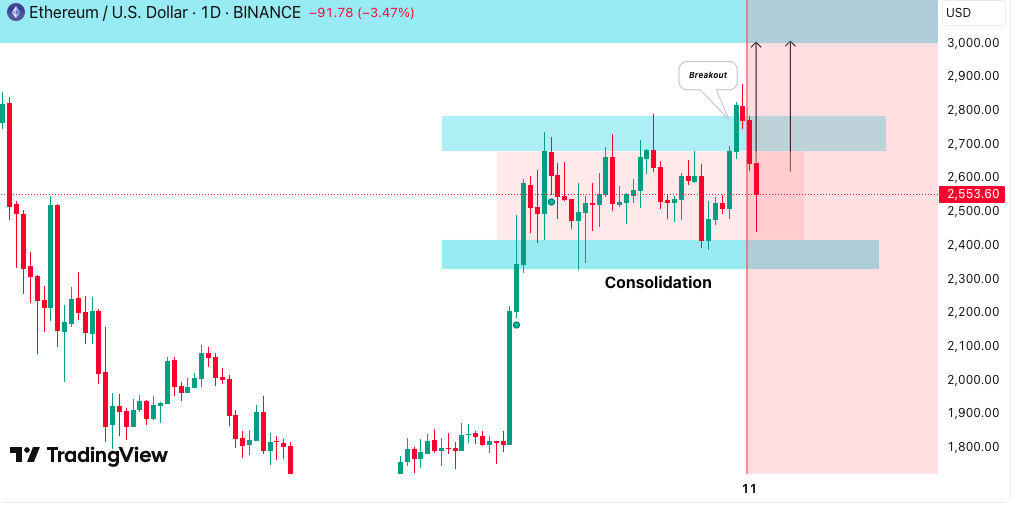

The Ethereum daily chart reveals that $ETH has been consolidating within a broad range between approximately $2,300 and $2,700, with current price action testing the lower boundary of this formation.

A major breakout occurred in late 2024, when $ETH surged from around $1,800 to nearly $2,900 before entering the current sideways consolidation phase.

The recent sell-off has pushed Ethereum back to test key support within this consolidation zone, specifically the $2,500-$2,550 area.

This level is key. If $ETH breaks below it decisively, the sideways trading could come to an end.

The price may then fall toward $2,300 or even test the $2,000 support level. However, if the current support holds strong, Ethereum could bounce back. In such a situation, the next targets would be $2,700-$2,800, the middle or top of its recent range.